Global Stock Markets commission-free

Invest from 1 Euro, Trade from 100 Euro

Hundreds of Stocks & Stock CFDs from various exchanges of the world commission-free! The offer is eligible for Trade.MT4, Trade.MT5, Invest MT5 accounts*.

Trade and invest in 8,000+ markets today

How it works

Register

Sign up with your name and email address to start trading

Fund

Start investing from €1, and start trading from €100

Trade

Log in and start trading more than 8,000 instruments!

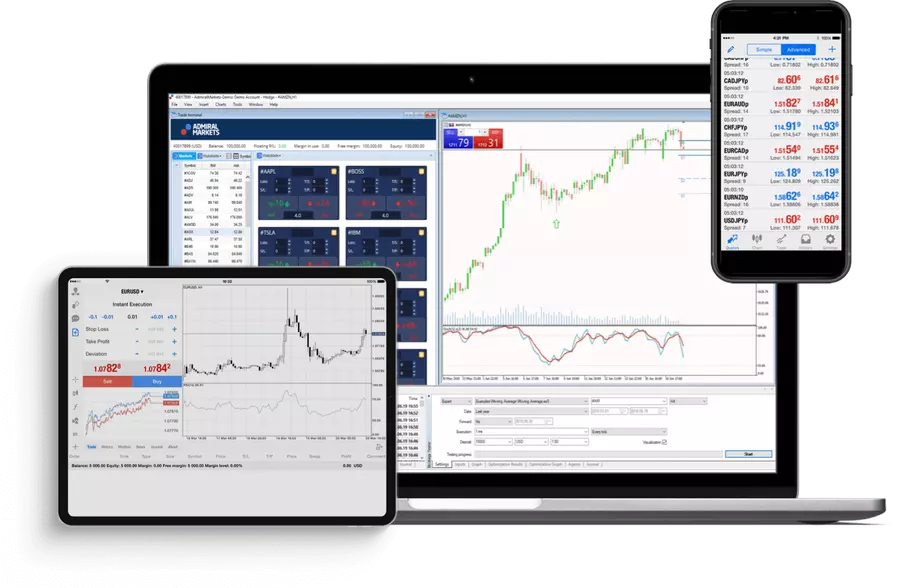

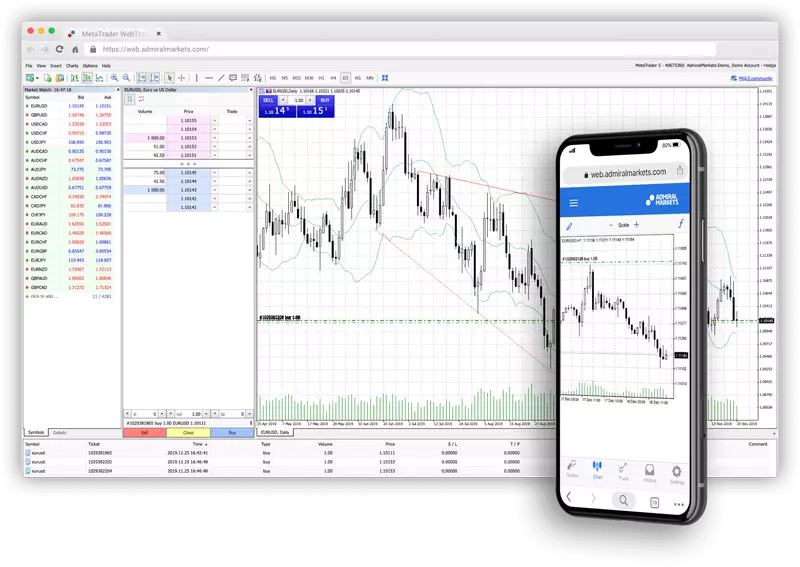

MetaTrader WebTrader platform

Trade anywhere, any time, without having to download any software. Whether you use a Mac or a PC, you can tap into to the markets via your browser hassle-free, with the WebTrader trading platform.

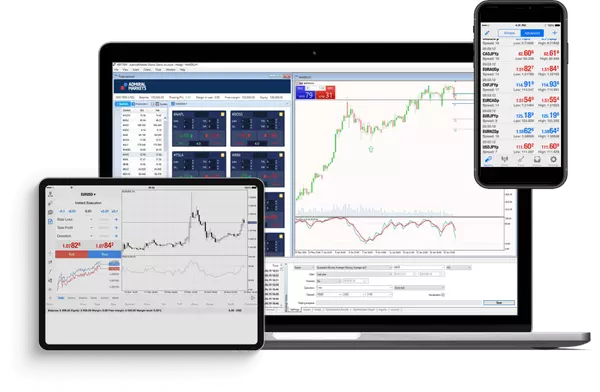

MetaTrader: The #1 tool for traders and investors worldwide

Trade or invest in 8,000+ trading instruments including Forex pairs, CFDs on indices, commodities, cryptocurrencies, shares, ETFs, and bonds, or purchase shares or exchange-traded funds. Available on both Windows and Mac.

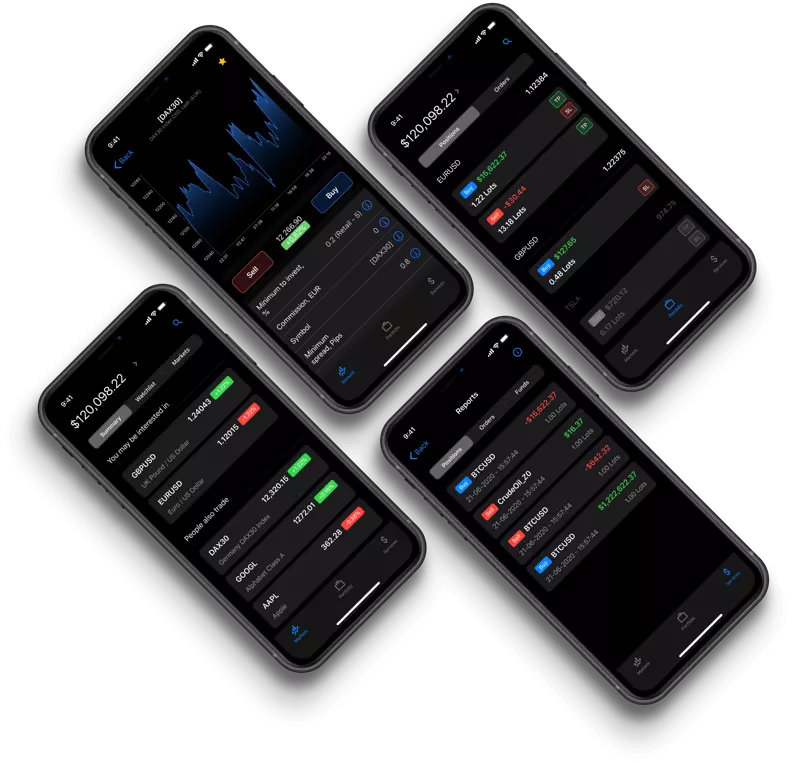

Trade with Admirals mobile app

Trade on-the-go with the Admirals mobile trading app! You can monitor the markets, access charts, open and close trades and more from your gadget. Available for iOS and Android.

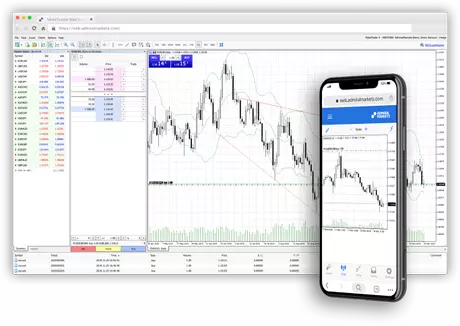

MetaTrader WebTrader platform

Trade anywhere, any time, without having to download any software. Whether you use a Mac or a PC, you can tap into to the markets via your browser hassle-free, with the WebTrader trading platform.

Top trading conditions

Trade our best conditions yet, including some of the market`s most competitive spreads!

- Leverage 1:2 - 1:500

- Forex typical spreads from 0.6 pips (EURUSD), micro lots and fractional shares

- Stocks CFDs — commission-free*

- Free real-time charts, market news and research

- 4,000+ CFDs on currencies, energies, metals, indices, stocks & digital currencies

- 4,500+ single shares and ETFs

Why choose Admirals?

We are global

Get support in your language, with 16 local offices and multilingual client support via phone, email and live chat

We are regulated

We are licensed by the world`s top regulators, in the UK, Estonia, Cyprus and Australia

Funds are secured

All client deposits are kept separate from our own operating funds, plus we offer extra protection in a volatile market

Start from €1

You can invest in stocks from €1, and start trading from €100

We are global

Get support in your language, with 16 local offices and multilingual client support via phone, email and live chat

We are regulated

We are licensed by the world`s top regulators, in the UK, Estonia, Cyprus and Australia

Funds are secured

All client deposits are kept separate from our own operating funds, plus we offer extra protection in a volatile market

Start from €1

You can invest in stocks from €1, and start trading from €100

Try demo trading

Not sure how to start? We`ve got you! Start practicing trading with virtual funds on the Admirals demo trading account.

No stress

No deposit

No credit card

Get in touch

More questions? Contact us today!