Admirals Card

Transform your finances with your Admirals Card.

Why use the Admirals Card?

Global Access

Use your VISA card to spend online and in shops.

One Account

Access your trading profits and funds instantly - invest, spend, and manage funds from one account.

Favourable Rates

Transfer money at interbank exchange rates - no unnecessary banking costs!

One card, many possibilities

Open

Open your virtual card just in couple of clicks and use it instantly, or order the physical one directly to your home address and start using upon receiving and activating.

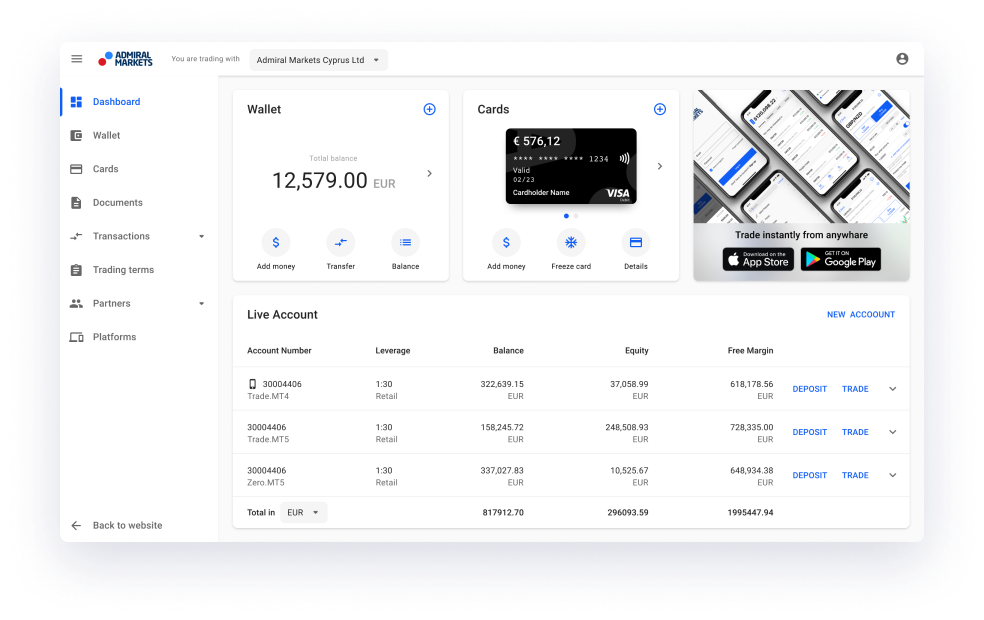

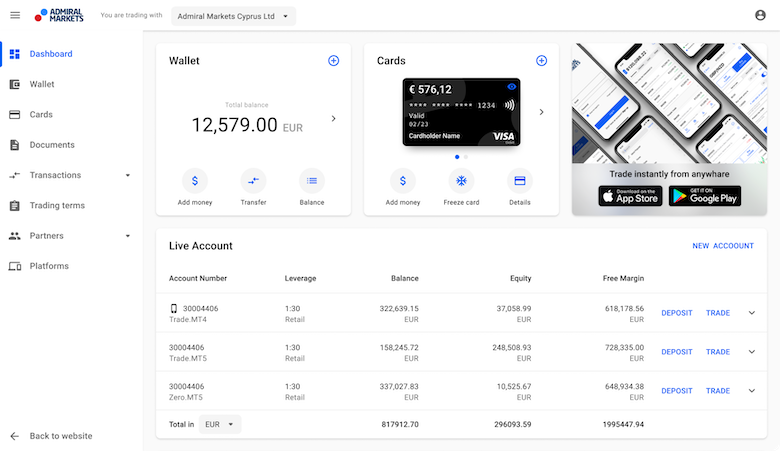

Manage Funds

One account for all your funds. Trading returns, deposits and card transactions viewable and easy to manage all online.

Spend

Use your physical or virtual Admirals Card online and in shops to purchase what you want safely & securely - anywhere, anytime.

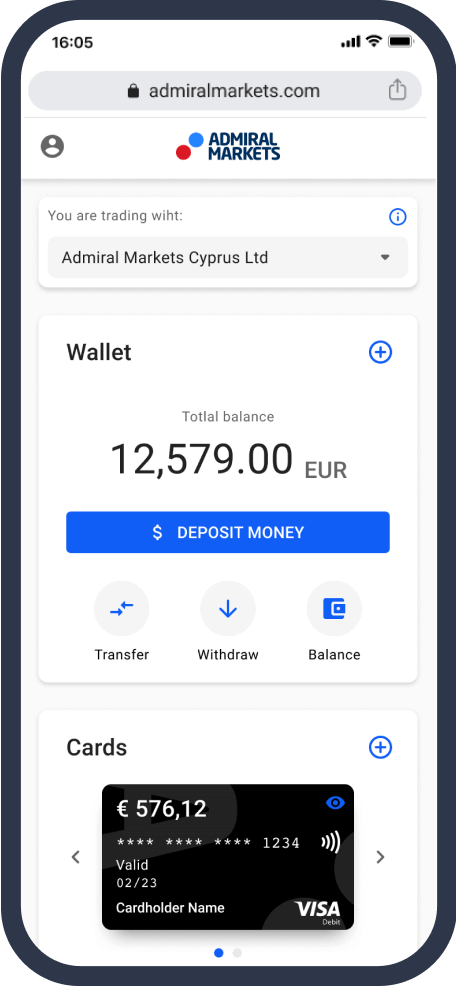

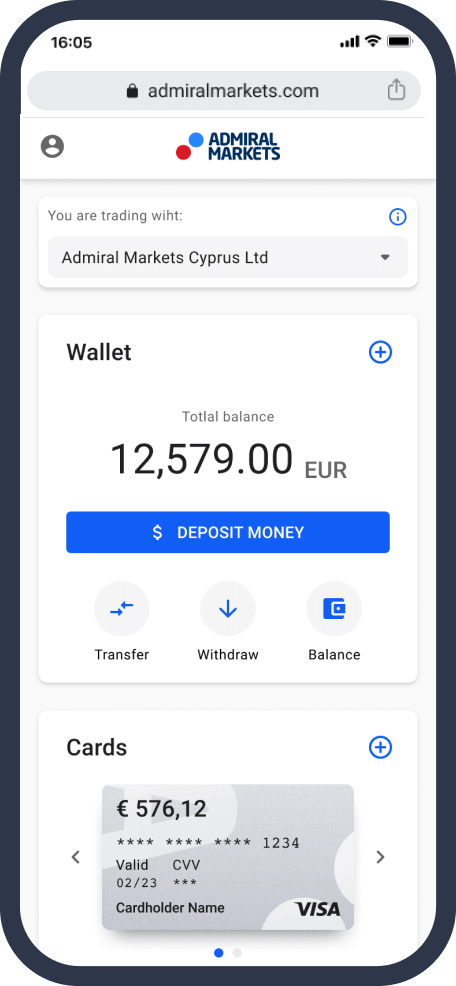

Which one to choose?

Physical and virtual cards are available to make purchasing easy

Cost Transparency

Transparent fees to put your mind at ease.

Worldwide Withdrawals

Access your funds at millions of ATMs around the world.

Widely Accepted

Spend anywhere in the world (and online) where VISA is accepted.

Transparent Costs

Knowing your card`s costs and fees allows you to plan your budget more effectively - T&C

Instantly Available

As a registered Admirals client you can apply for the Admirals Card at the click of a button.

Widely Accepted

Spend on any site where VISA is accepted - use at millions of online merchants.

Log in to get your Card

Log in to your Dashboard to open your Admirals Card account today!

Simple

Instant access to your trading balance. Available for clients with approved application.

Secure

Manage and use your card anywhere. Compatible with Samsung Pay and Google Pay.

Frequently asked questions

The Admirals Card is available as either a virtual card or a Visa card. With them, you can make purchases, both online or in physical stores, using the funds you have transferred into your card’s wallet within your Dashboard account.

Your card can be loaded up to a balance of 12.000 euro, and can be re-loaded any time when required.

Admirals virtual and physical cards are available to Admirals Europe Ltd private entity clients who are at least 18 years old, with an EEA residentship. Once your application has been approved, you see the “Cards” section in the dashboard where you can request your card.

Your Admirals Card can be used worldwide, wherever you see a Visa acceptance mark. This includes shops, restaurants, online shopping, and much, much more.

You can order up to 5 virtual cards per calendar month but you can not hold more than 1 virtual card at a time.You can also request 1 physical card. Please note: if you have not lost your physical card and decide to close it, you will not be able to request a new one. We advise you to freeze the card instead. You can unfreeze it at any time and resume use of the card.

Yes, please let us know as soon as possible if you wish to change your first or last name, mobile number, or address by contacting our Customer service.

You can check your card’s balance in your Dashboard. With physical cards you can also check your balance at ATMs (fees apply) displaying the Visa logo.

You can top up your card in your Dashboard using external payment systems (the same systems you use for deposits to your Wallet or Trading Account). You can then transfer funds from your Wallet or Trading Account to Admirals Card.

You can absolutely add the card to your Google Pay app. If the Google Pay app is not available in your region or country, please go to Settings -> Google -> Account services -> Google Pay -> add a payment method and click “Add a new card” within your phone. You can find more information at Google Pay Help.

Yes, your card is compatible with Samsung Pay on Samsung phones and devices. To find more information about compatible devices, regions, and any other information, please visit the Samsung Pay page.

You can generate a statement in your Dashboard (“Cards” menu) for your selected date range. Select “Range” and filter by “Time” and your desired set start and end dates. The statement will be generated as a PDF file.

You can contact us in any convenient way. Depending on your location, options include email, telephone and Whatsapp. Please check Contact us page.

You can make a dispute a paymentin your Dashboard. Select the transaction in Dashboard (“Cards” menu), click “Dispute” and add all relevant information.

Creating your virtual card takes seconds, and is available immediately after creation. You can start using your virtual card once created, and funds have been transferred into your card.

You can close the card in your Dashboard. If the card has balance above zero, please transfer the full balance on the card into a trading account or wallet before closing the card.

The card fee depends on your Admirals Account status (Value or VIP), please check more information on Admirals Card Fees page or in Terms and Conditions document.

Your physical Admiral Markets card should arrive within 10 days via local post to the home address displayed to you in the process of requesting the card. If you didn’t receive it and have questions about the delivery, please Contact us. The card is being delivered via local post, thus tracking is not provided. Please note: there may be delivery delays due to COVID-19.

After your physical card has been created and delivered to you, you will need to activate it in your Dashboard. After that, you can start using your physical card as soon as funds have been loaded onto it.

You can activate your physical card in your Dashboard, clicking the “Activate” option and simply following the instructions.

You can close the card in your Dashboard. If the card has a non-zero balance, please transfer the full balance to a trading account or wallet and then close the card.

Please note: if you have not lost your physical card and decide to close it, you will not be able to request a new one. We advise you to freeze the card instead. You can unfreeze it at any time and resume use of the card.

To activate contactless payments with a physical card, use your card with your PIN at a physical ATM or point of sale. After this, you will be able to use the card for contactless payments.

If you lose your card or it is stolen or you suspect that someone else has found out your PIN or security information or accessed your account without your permission, notify us without undue delay by calling +44 (0)333 202 3645 or logging in to your Dashboard and selecting the “Close and replace” option for this card. If, after reporting a lost card, you subsequently find the card, do not use it. Cut it in half through the signature box, magnetic strip and chip.

If you are not sure if the card was lost or stolen and you’d like to block it temporarily, please select the “Freeze” option. You can unfreeze the card at any later time.

You can retrieve your PIN by logging in to your Dashboard (“Cards” menu), clicking the “View PIN” option, and simply following the instructions.

If you want to change your PIN, you can do so at any ATM with PIN management functionality. Locate ATMs with the “PIN change” function at https://www.visa.com/atmlocator. You can receive a reminder of your PIN through your Dashboard.

To keep your card and security credentials safe, do not give this information to anyone else nor let anyone use it. Keep your security details secret at all times; never disclose your PIN and security information to anyone else nor store the details of your PIN with your card.