How to Trade Palantir After Fiscal Q3 2025 Performance

Founded in 2003 and headquartered in Denver, Colorado, Palantir Technologies Inc. (NYSE: PLTR) is a rapidly growing enterprise software company which specialises in AI-driven data analytics platforms for both government and commercial sectors.

Learn more about Palantir’s fiscal third-quarter 2025 performance and what analysts are forecasting for the stock. This material is for informational purposes only and not financial advice. Consult a financial advisor before making investment decisions.

- The Invest.MT5 account allows you to buy real stocks and shares from some of the largest stock exchanges in the world.

- Risk Warning: Past performance is not a reliable indicator of future results or future performance. All trading is high risk, and you can lose more than you risk on a trade. Never invest more than you can afford to lose as some trades will lose and some trades will win. Start small to understand your own risk tolerance levels or practice on a demo account first to build your knowledge before investing.

- Trading is not suitable for everyone. Trading is highly speculative and carries a significant risk of loss. While it offers potential opportunities, it also involves high volatility, and leveraged trading can amplify both gains and losses. Retail investors should fully understand these risks before trading.

Palantir Fiscal Q3 2025 Performance Summary

Key Takeaways

- Palantir posted a better-than-expected quarter with 63% revenue growth and an earnings beat.

- Its US commercial segment is accelerating rapidly (+121 % y/y) which marks an important shift away from government contract reliance.

- The company raised its full-year revenue guidance for 2025 to roughly $4.396 billion to $4.400 billion.

- While growth seems strong, concerns remain around whether the rate of growth can be sustained, given high AI technology expectations and valuations.

Source: Palantir Quarterly Results

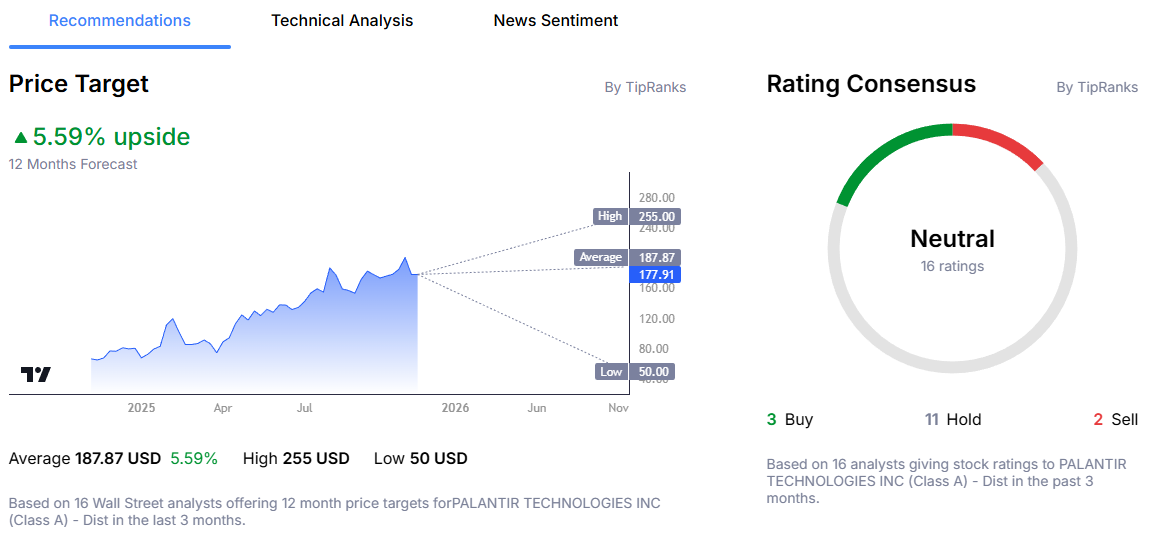

Palantir 12-Month Analyst Stock Price Forecast

According to 16 Wall Street analysts, polled by TipRanks, offering a 12-month stock price forecast for Palantir over the past 3 months:

- Buy Ratings: 3

- Hold Ratings: 11

- Sell Ratings: 2

- Average Price Target: $187.87

- High Price Target: $255.00

- Low Price Target: $50.00

Trading Strategy Example: Palantir

The following trading examples are for educational purposes only and do not constitute investment advice. Investors should conduct independent research before making trading decisions. An example trading idea for the Palantir share price could be as follows:

Remember that markets are volatile. Despite the strong earnings beat and upgraded guidance, Palantir’s stock price will fluctuate. It's important to take into consideration the high potential of a deceleration in growth, heavy reliance on government contracts, competitive risks from the AI sector as a whole and stretched valuations.

How to Buy Palantir Stock in 4 Steps

- Open an account with Admiral Markets by completing the onboarding process.

- Click on Trade or Invest on one of your live or demo accounts to open the web platform.

- Search for your stock in the search window at the top.

- Input your entry, stop-loss and take profit levels in the trading ticket.

Do You See the Palantir Stock Price Moving Differently?

If you believe there is a higher chance the share price of Palantir will move lower, then you can also trade short using CFDs (Contracts for Difference). However, these have higher associated risks and are not suitable for all investors. Learn more about CFDs in this How to Trade CFDs article.

INFORMATION ABOUT ANALYTICAL MATERIALS:

The given data provides additional information regarding all analysis, estimates, prognosis, forecasts, market reviews, weekly outlooks or other similar assessments or information (hereinafter “Analysis”) published on the websites of Admiral Markets investment firms operating under the Admiral Markets trademark (hereinafter “Admiral Markets”) Before making any investment decisions please pay close attention to the following:

- This is a marketing communication. The content is published for informative purposes only and is in no way to be construed as investment advice or recommendation. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and that it is not subject to any prohibition on dealing ahead of the dissemination of investment research.

- Any investment decision is made by each client alone whereas Admiral Markets shall not be responsible for any loss or damage arising from any such decision, whether or not based on the content.

- With view to protecting the interests of our clients and the objectivity of the Analysis, Admiral Markets has established relevant internal procedures for prevention and management of conflicts of interest.

- The Analysis is prepared by an analyst (hereinafter “Author”). The Author Admiral Markets is an employee /a contractor for Admiral Markets. This content is a marketing communication and does not constitute independent financial research.

- Whilst every reasonable effort is taken to ensure that all sources of the content are reliable and that all information is presented, as much as possible, in an understandable, timely, precise and complete manner, Admiral Markets does not guarantee the accuracy or completeness of any information contained within the Analysis.

- Any kind of past or modelled performance of financial instruments indicated within the content should not be construed as an express or implied promise, guarantee or implication by Admiral Markets for any future performance. The value of the financial instrument may both increase and decrease and the preservation of the asset value is not guaranteed.

- Leveraged products (including contracts for difference) are speculative in nature and may result in losses or profit. Before you start trading, please ensure that you fully understand the risks involved.