Combine leading providers for smarter trading

- Access real-time insights and analytics from DowJones and Acuity in one tool.

- Simplify your trading process with unified market data and analysis.

- Rely on globally trusted providers to drive informed decisions.

Why choose the Admirals Research Terminal?

- Real data and news in real time

- Integration of analytics and market signals

- AI-driven processing of financial data

- Customizable control and annunciation panels

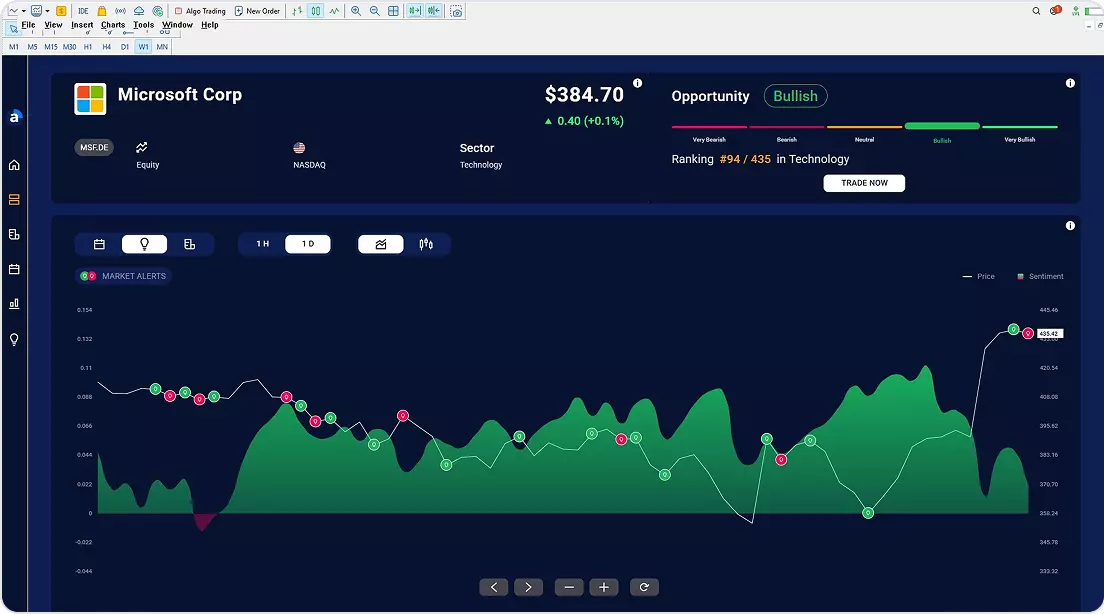

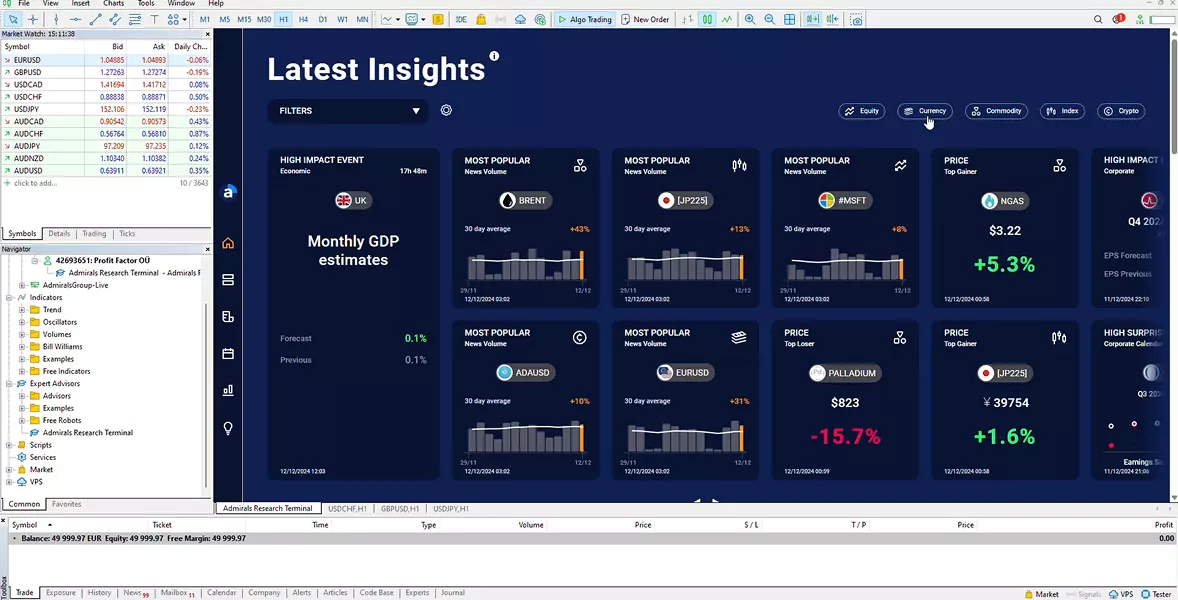

For experienced traders using MT4/5

Powerful tools inside MT4/5

Integrate advanced market analysis directly into your trading platform

Stay ahead with real-time data

Customize your trading experience with real-time insights

Powerful features to elevate your trading

A powerful, all-in-one research solution for traders and investors. Stay ahead with real-time data, AI-driven insights, and customizable tools

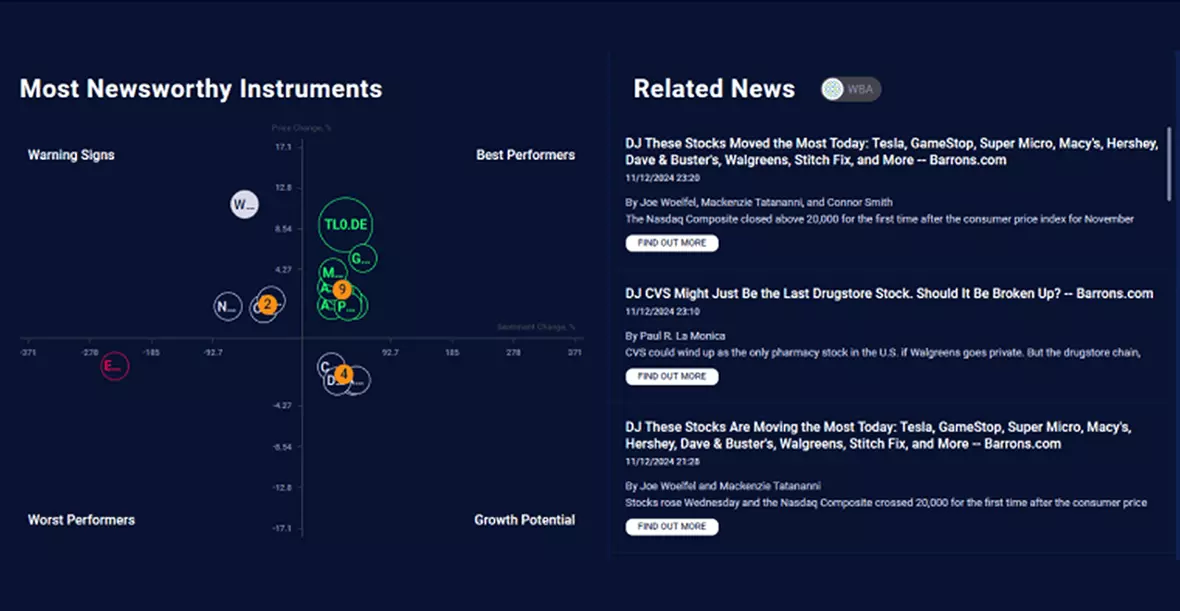

Alternative data signals

Analyze news and price movements for more accurate trend forecasting

Abnormal news volume detection

Detecting abnormally high news volume to identify market events

Corp and macro event analysis

Predicting market reactions to events

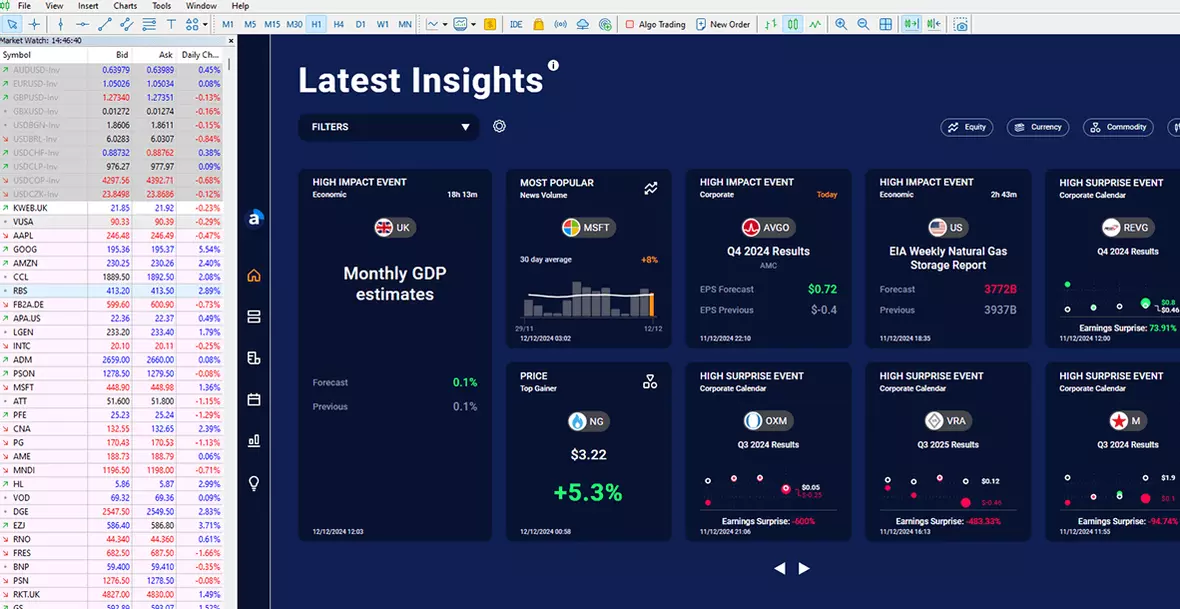

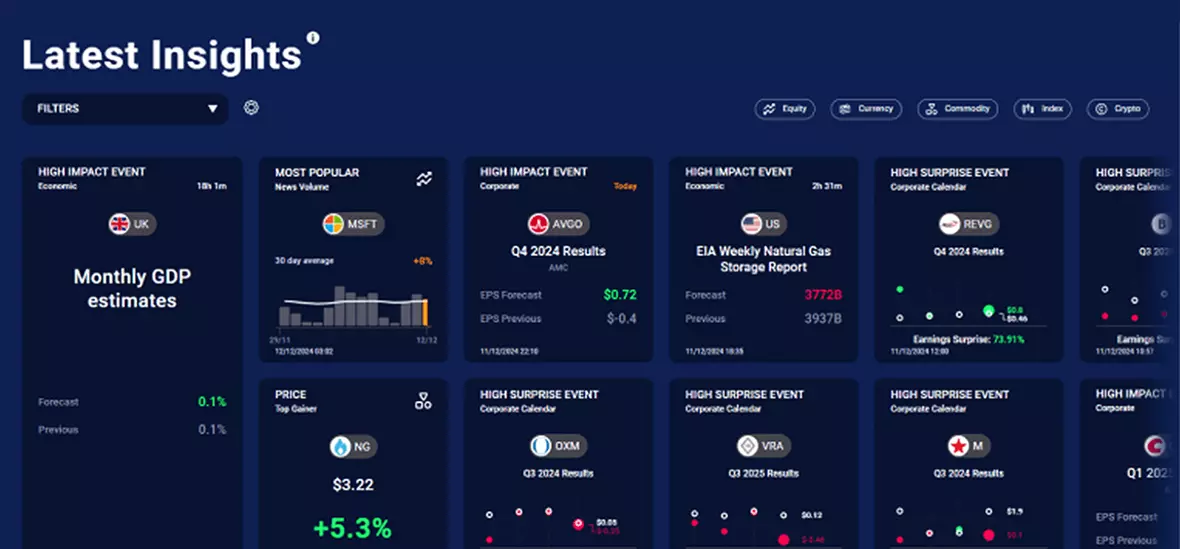

Detected market insights

Detecting latest markets insights among top movers in price, hot trade ideas, and high impact economic and corporate events

How the Admirals Research Terminal works

AI-powered, real-time insights at your fingertips

Frequently asked questions

Explore the most common questions asked by our users

The Admirals Research Terminal is an all-in-one market research platform designed to help both traders and investors stay ahead of the market. By combining real-time financial data, AI-driven insights, and a wide range of other data sources, it helps users identify trading opportunities, monitor market trends, and make informed investment decisions—all in one place.

The platform removes the inefficiencies of traditional research tools by integrating real-time market data, news, and analytics into a single, user-friendly interface.

Whether you’re a short-term trader looking for high-probability trade setups or a long-term investor assessing market trends, the platform provides:

- Customizable dashboards to track market movements that matter to you.

- Real-time alerts for breaking news, earnings, and economic events.

- Data-driven insights that make complex analysis faster and easier.

The platform is powered by advanced AI technology that processes vast amounts of structured and unstructured financial data. This enables:

- Predictive analytics to highlight potential price movements.

- News and sentiment analysis to gauge market mood.

- Automated trade signals based on historical and technical data.

The platform offers a range of powerful tools to support both trading strategies and investment decisions:

- Top Movers Based on Price – Highlights assets with the biggest daily gains and losses, helping traders spot trends and investors monitor volatility.

- High-Impact Economic Events – Tracks upcoming macroeconomic events (e.g., interest rate decisions, inflation data) that can drive market shifts.

- Anticipated Earnings Events – Provides insight into key corporate earnings reports, helping investors assess potential stock price movements.

- Hot Trade Ideas – Offers trading insights based on AI-driven analysis.

- Market Alerts – Identifies alternative trade ideas beyond traditional technical signals.

- News Volume Metrics – Detects unusual spikes in news coverage, signaling significant market events.

- High-Surprise Earnings Events – Flags companies that have significantly exceeded or missed earnings expectations, often leading to sharp price reactions.

- High-Surprise Economic Events – Highlights major economic reports that diverge from forecasts, causing potential volatility in stocks, forex, and commodities.

For those who prefer detailed research and in-depth market analysis, the platform offers:

- AssetIQ – A comprehensive tool for analyzing individual assets, including historical price trends and sentiment indicators.

- Corporate Calendar – Tracks important corporate events such as earnings releases, dividend announcements, and stock splits.

- Technical Analysis Insights – Uses AI-powered market analysis to identify trade signals based on historical price movements and chart patterns.

The Hot News section provides real-time access to the most significant financial news, sourced from Dow Jones. It highlights:

- Major market-moving events, such as central bank decisions and corporate earnings.

- Breaking financial news that influences stock prices, commodities, and forex.

- Customizable alerts, ensure users stay informed about important updates.

Both traders and investors can use this tool to stay ahead of major financial developments.

Yes, the platform offers extensive customization options to suit different trading and investment styles:

- Custom Watchlists – Monitor specific assets or sectors.

- Personalized Alerts – Get notifications for price movements, economic events, or key financial news.

- Adjustable Layouts & Dashboards – Tailor your workspace to focus on the data that matters most to you.

The Admirals Research Terminal was developed by Acuity as a comprehensive market intelligence platform. Its goal is to provide both traders and investors with AI-driven insights, real-time financial data, and expert research tools, helping them stay ahead in today’s dynamic financial markets.