How to Trade Delta Air Lines After Q3 2025 Performance

Founded nearly a century ago, headquartered in Atlanta, Georgia, Delta Air Lines Inc. (NYSE: DAL) is a global leader in aviation. With flights to more than 275 destinations across 50 countries and as many as 4,000 daily departures, Delta carries millions of passengers every year. It also offers cargo services, aircraft maintenance, and travel packages besides passenger travel.

The company recently reported its third-quarter 2025 results. Here’s a closer look at the performance and what analysts are forecasting for the stock.

This material is for informational purposes only and not financial advice. Consult a financial advisor before making investment decisions.

- The Invest.MT5 account allows you to buy real stocks and shares from some of the largest stock exchanges in the world.

- Risk Warning: Past performance is not a reliable indicator of future results or future performance. All trading is high risk, and you can lose more than you risk on a trade. Never invest more than you can afford to lose as some trades will lose and some trades will win. Start small to understand your own risk tolerance levels or practice on a demo account first to build your knowledge before investing.

- Trading is not suitable for everyone. Trading is highly speculative and carries a significant risk of loss. While it offers potential opportunities, it also involves high volatility, and leveraged trading can amplify both gains and losses. Retail investors should fully understand these risks before trading.

Delta Air Lines Q3 2025 Performance Summary

*Figures are Non-GAAP (Generally Accepted Accounting Principles).

Key Takeaways

- Delta delivered record September quarter revenue of $15.2 billion (non-GAAP), up 4.1% year-on-year (YoY), with earnings per share of $1.71.

- The company generated $1.8 billion in adjusted operating cash flow during the quarter. After $1.1 billion in capital expenditures, the airline’s free cash flow came to $833 million.

- Debt levels continued to improve. At the end of the September quarter, total debt and finance-lease obligations were $14.9 billion, down 16% compared with the same period a year ago.

- For Q4 2025, Delta is projecting an operating margin of 10.5% to 12% and full-year adjusted EPS of approximately $6.

Source: Delta Air Lines Quarterly Results

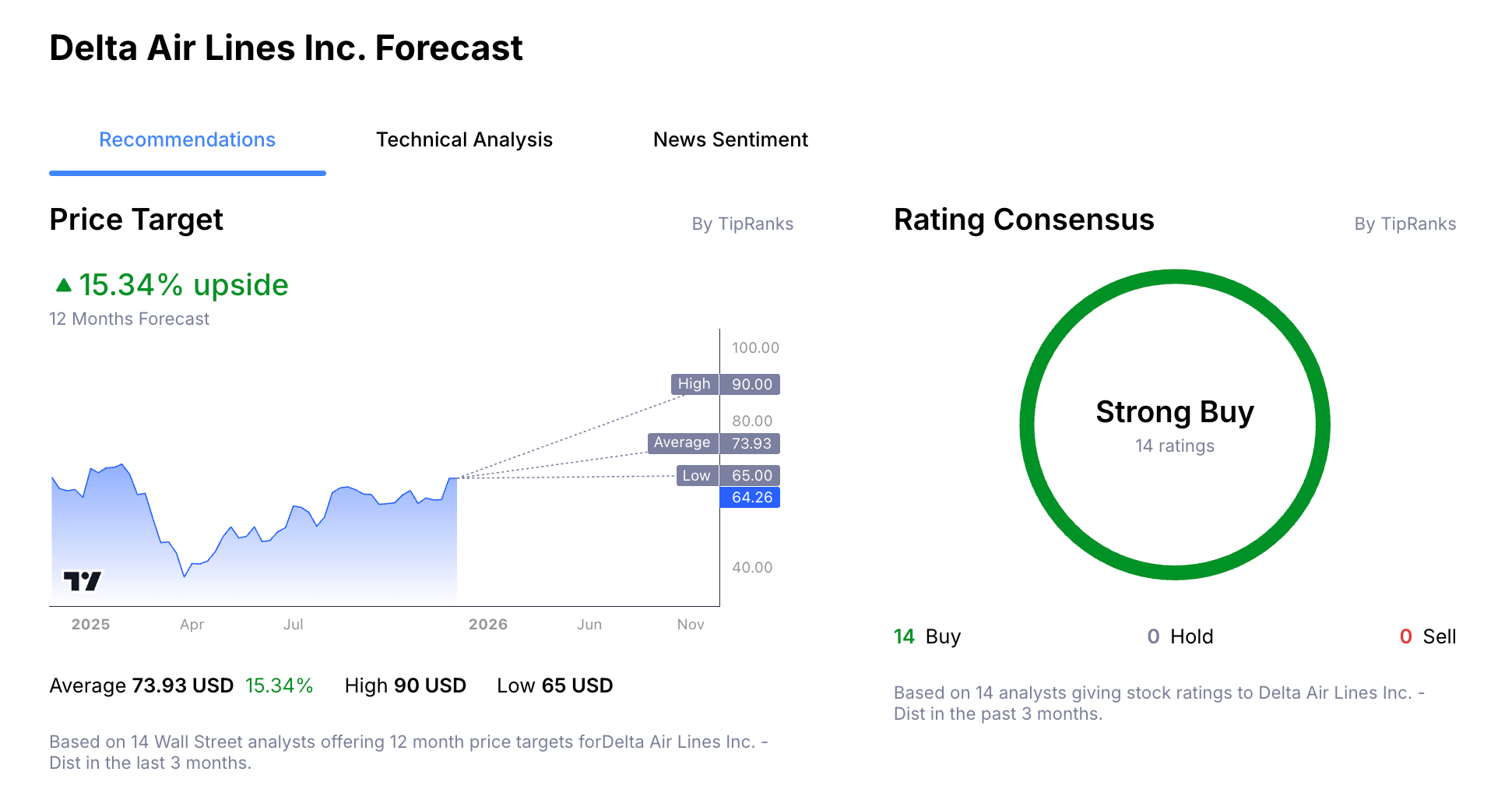

Delta Air Lines 12-Month Analyst Stock Price Forecast

According to 14 Wall Street analysts, polled by TipRanks, offering a 12-month stock price forecast for Delta Air Lines over the past 3 months:

- Buy Ratings: 14

- Hold Ratings: 0

- Sell Ratings: 0

- Average Price Target: $73.93

- High Price Target: $90.00

- Low Price Target: $65.00

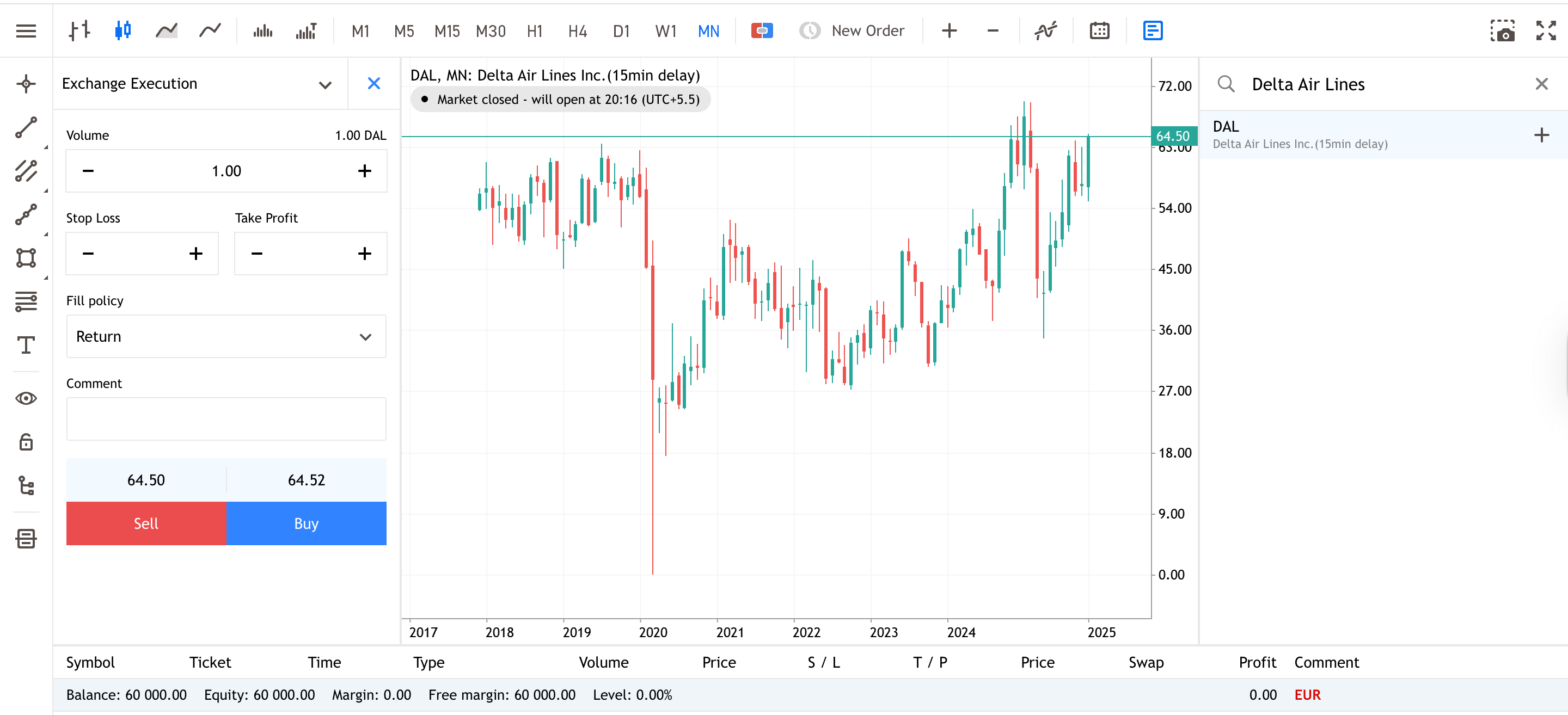

Trading Strategy Example: Delta Air Lines

The following trading examples are for educational purposes only and do not constitute investment advice. Investors should conduct independent research before making trading decisions. An example trading idea for the Delta Air Lines share price could be as follows:

Remember that markets are volatile, and the stock price of Delta Air Lines will fluctuate and may even trend lower. Fuel cost is one of the most important operating expenses for the company and any change in it could impact on the profitability of the airline. Furthermore, the aviation sector tends to be sensitive to economic conditions, and hence Delta could be more exposed in the event of a downturn.

How to Buy Delta Air Lines Stock in 4 Steps

- Open an account with Admirals and complete the onboarding process to access the dashboard.

- Click on Trade or Invest on one of your live or demo accounts to open the web platform.

- Search for your stock in the search window at the top.

- Input your entry, stop-loss and take profit levels in the trading ticket.

Do You See Delta Air Lines' Stock Price Moving Differently

If you believe there is a higher chance the share price of Delta Air Lines will move lower, then you can also trade short using CFDs (Contracts for Difference). However, these have higher associated risks and are not suitable for all investors. Learn more about CFDs in this How to Trade CFDs article.

INFORMATION ABOUT ANALYTICAL MATERIALS:

The given data provides additional information regarding all analysis, estimates, prognosis, forecasts, market reviews, weekly outlooks or other similar assessments or information (hereinafter “Analysis”) published on the websites of Admirals investment firms operating under the Admirals trademark (hereinafter “Admirals”) Before making any investment decisions please pay close attention to the following:

- This is a marketing communication. The content is published for informative purposes only and is in no way to be construed as investment advice or recommendation. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and that it is not subject to any prohibition on dealing ahead of the dissemination of investment research.

- Any investment decision is made by each client alone whereas Admirals shall not be responsible for any loss or damage arising from any such decision, whether or not based on the content.

- With view to protecting the interests of our clients and the objectivity of the Analysis, Admirals has established relevant internal procedures for prevention and management of conflicts of interest.

- The Analysis is prepared by an analyst (hereinafter “Author”). The Author Clarice Mendonsa is a contractor for Admirals. This content is a marketing communication and does not constitute independent financial research.

- Whilst every reasonable effort is taken to ensure that all sources of the content are reliable and that all information is presented, as much as possible, in an understandable, timely, precise and complete manner, Admirals does not guarantee the accuracy or completeness of any information contained within the Analysis.

- Any kind of past or modelled performance of financial instruments indicated within the content should not be construed as an express or implied promise, guarantee or implication by Admirals for any future performance. The value of the financial instrument may both increase and decrease and the preservation of the asset value is not guaranteed.

- Leveraged products (including contracts for difference) are speculative in nature and may result in losses or profit. Before you start trading, please ensure that you fully understand the risks involved.