Fai trading e investi in oltre 8.000 mercati oggi

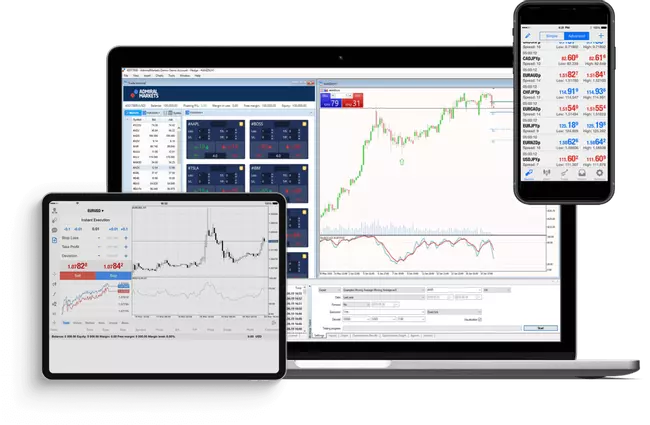

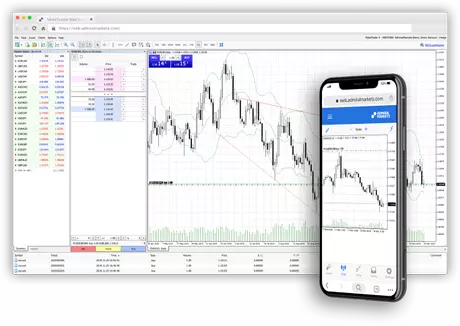

MetaTrader: Lo strumento #1 per trader e investitori in tutto il mondo

Fai trading o investi in oltre 8.000 strumenti di trading, tra cui coppie Forex, CFD su indici, materie prime, criptovalute, azioni ed ETF, oppure acquista azioni o fondi negoziati in borsa. Disponibile sia su Windows che su Mac.

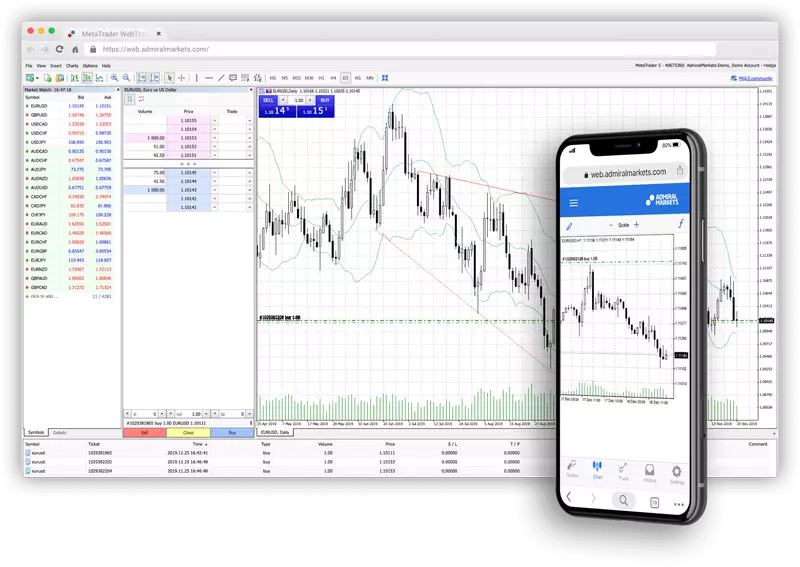

Piattaforma MetaTrader WebTrader

Opera ovunque, in qualsiasi momento, senza dover scaricare alcun software. Se si utilizza un Mac o un PC, è possibile accedere ai mercati tramite il browser senza problemi, con la piattaforma di trading WebTrader.

MetaTrader: Lo strumento #1 per trader e investitori in tutto il mondo

Fai trading o investi in oltre 8.000 strumenti di trading, tra cui coppie Forex, CFD su indici, materie prime, criptovalute, azioni ed ETF, oppure acquista azioni o fondi negoziati in borsa. Disponibile sia su Windows che su Mac.

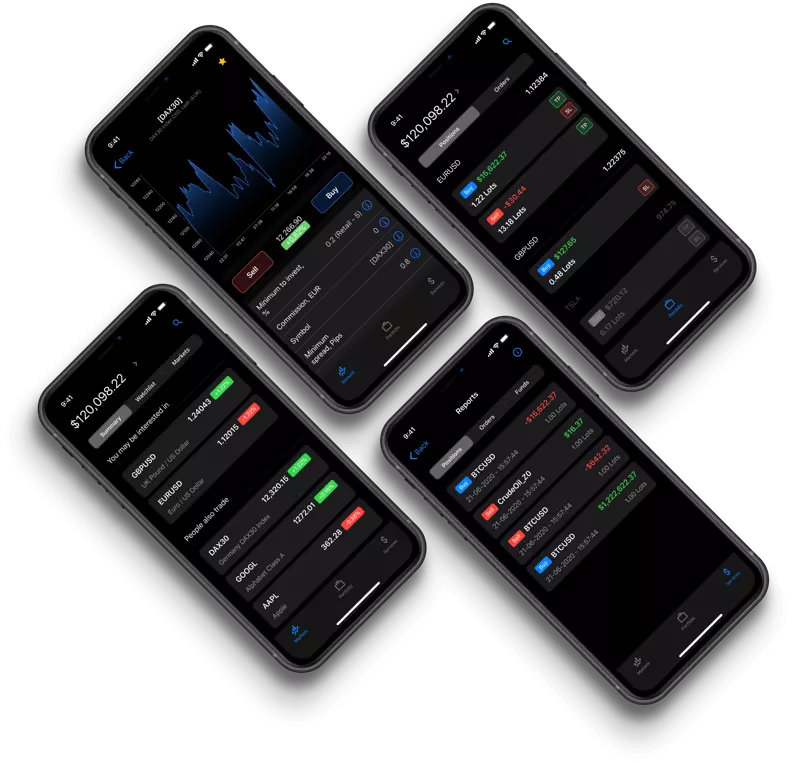

Fai trading con l`app mobile di Admirals

Fai trading on-the-go con l`applicazione di trading mobile Admirals! Puoi monitorare i mercati, accedere ai grafici, aprire e chiudere operazioni e molto altro ancora dal tuo gadget. Disponibile per iOS e Android.

Piattaforma MetaTrader WebTrader

Opera ovunque, in qualsiasi momento, senza dover scaricare alcun software. Se si utilizza un Mac o un PC, è possibile accedere ai mercati tramite il browser senza problemi, con la piattaforma di trading WebTrader.

Le migliori condizioni di trading

Godi delle nostre migliori condizioni, tra cui alcuni degli spread più competitivi del mercato!

- Leva 1:2 - 1:30

- Spread Forex tipico da 0.6 pips (EURUSD), micro lotti e azioni frazionate

- Grafici in tempo reale, notizie di mercato e ricerche gratis

- Più di 4000 CFD su valute, energia, metalli, indici, azioni e valute digitali

- Oltre 4.500 azioni e ETF

Il trading di CFD è rischioso. Potresti perdere tutto il capitale investito.

Si applicano T&C e commissioni.

Perché scegliere Admirals?

Supporto a tua portata di mano

Ricevi supporto personalizzato con assistenza multilingue tramite telefono, e-mail e chat dal vivo

I fondi sono al sicuro

Tutti i depositi dei clienti sono tenuti separati dai nostri fondi operativi. Il denaro dei clienti è trattenuto in conti bancari designati per i clienti, assicurando che sia protetto e separato dai nostri fondi

Inizia da €1

Puoi investire in azioni a partire da 1€

Supporto a tua portata di mano

Ricevi supporto personalizzato con assistenza multilingue tramite telefono, e-mail e chat dal vivo

I fondi sono al sicuro

Tutti i depositi dei clienti sono tenuti separati dai nostri fondi operativi. Il denaro dei clienti è trattenuto in conti bancari designati per i clienti, assicurando che sia protetto e separato dai nostri fondi

Inizia da €1

Puoi investire in azioni a partire da 1€

Prova il trading demo

Non sei sicuro di come iniziare? Ci pensiamo noi! Inizia ad esercitarti nel trading con fondi virtuali sul conto demo di Admirals.

Senza stress

Senza deposito

Senza carta di credito

Contattaci

Altre domande? Contattaci oggi!