Trade and invest in 8,000+ instruments today

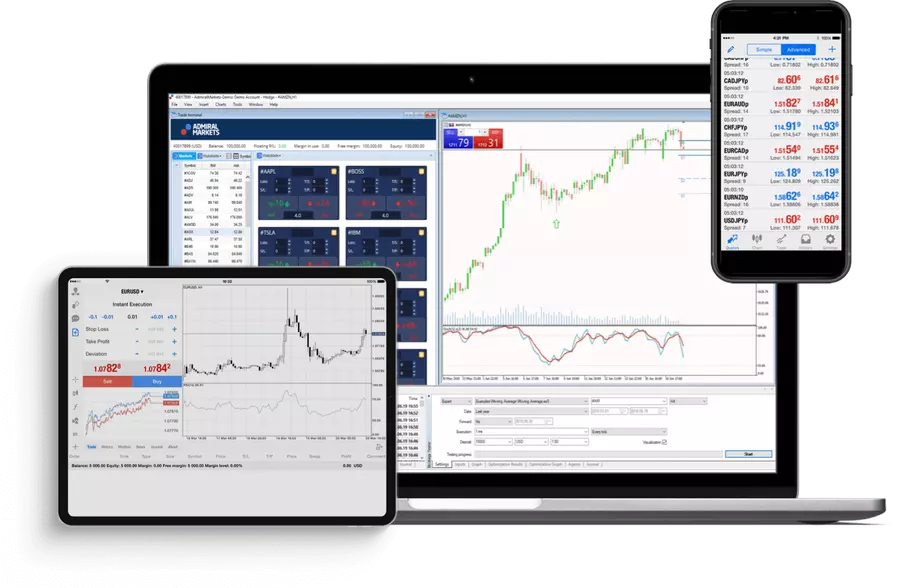

Top trading conditions

Trade our best conditions yet, including some of the market`s most competitive spreads!

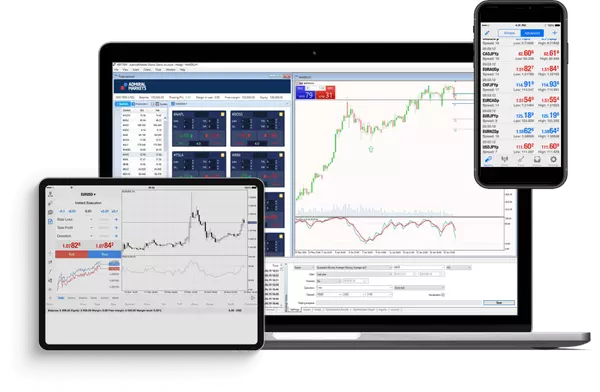

- Leverage and margin trading

- Forex typical spreads from 0.6 pips (EURUSD), micro lots and fractional shares

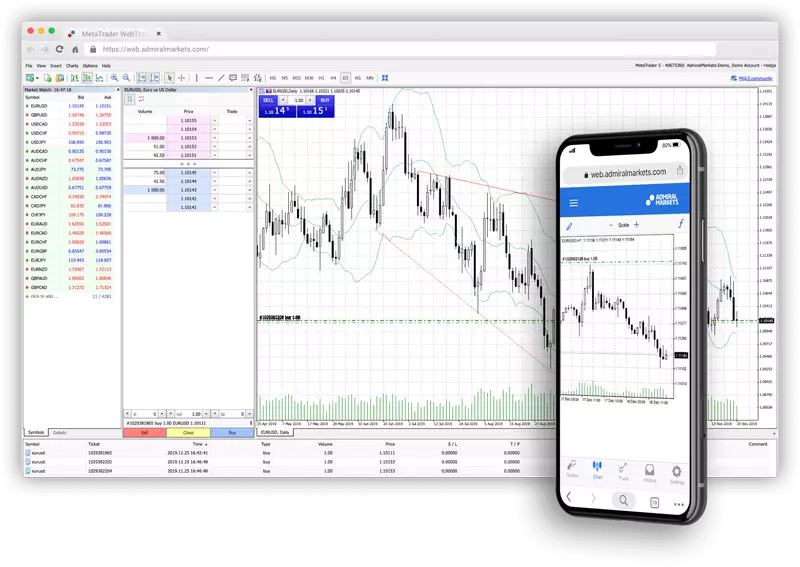

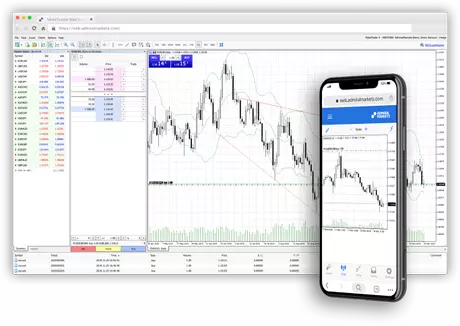

- Free real-time charts, market news and research

- 4,000+ CFDs on currencies, energies, metals, agricultures, indices, bonds, ETFs & stocks.

- 4,500+ single shares and ETFs

Why choose Admiral Markets?

Support at Your Fingertips

Get personalized support with multilingual assistance via phone, email, and live chat

Funds are secured

All client deposits are kept separate from our own operating funds. Client money is held in designated client bank accounts, ensuring it is protected and segregated from our own funds