ADMIRAL MARKETS PTY LTD PRODUCT DISCLOSURE STATEMENT

Valid as of 30th of March 2020

Section 1 – Important Information

1.1 PDS

This Product Disclosure Statement (PDS) has been prepared by Admiral Markets Pty Ltd, ABN 63 151 613 839; AFSL 410 681 (hereinafter as Admiral), as the issuer of the following over the counter (OTC) Products (collectively referred to as Admiral Products):

- Spot foreign exchange currency pairs (FX);

- Commodity Derivatives (based on metals, energy, and agricultural products);

- Exchange-Traded Funds (ETFs) Derivatives;

- Equity Derivatives;

- Index Derivatives;

- Bonds Derivatives, and

- Cryptocurrency Derivatives.

All Admiral Products are traded on Admiral MT terminal and are over-the-counter-derivative financial products issued by Admiral to clients in a form of Contracts-for-Difference (CFDs). CFDs are not exchange-traded financial products. CFDs give the holder a long or short exposure to fluctuations in the price, level or value of an underlying asset and must be settled in cash.

This PDS describes the key features of Admiral Products, their benefits, risks, the costs and fees of trading in Admiral Products and other related information. Admiral Products are sophisticated financial products so you should read this PDS and the Account Terms in full before making any decision to invest in them. Please read the Key Information in Section 2 and the Significant Risks in Section 4.

This PDS is designed to help you decide whether the Admiral Products described in this PDS are appropriate for you. You may also use this PDS to compare this financial product with similar financial products offered by other issuers.

Distribution of the products under this PDS is not permitted in jurisdictions where it is illegal to make such distribution. Some expressions used in this PDS have definitions given in the Glossary at the end of this PDS (see Section 7).

1.2 Your Liability

Your potential liability is not limited to the amount paid to Admiral or that is kept by Admiral Trust Account, Wholesale Client Trust account, or the Security Trust Bank Account for you. Admiral may ask you to pay amounts in excess of those amounts to cover any shortfall.

You should carefully consider the risks of Admiral Products and your capacity to meet your liability before investing in Admiral Products.

1.3 Admiral does not give personal advice

Admiral will not give their clients personal financial advice. This PDS does not constitute a recommendation or opinion that Admiral Products are appropriate for you.

Trading in foreign exchange and derivative products carries significant risks. You can lose an amount in excess of your initial investment.

Potential investors should be experienced in OTC and derivative financial products and understand and accept the risks of investing in Admiral Products. The information in this PDS is general only and does not take into account your personal objectives, financial situation and needs. This PDS does not constitute advice to you on whether Admiral Products are appropriate for you. This PDS describes the Admiral Products which are issued to you in accordance with the Account Terms. You should read the entire PDS and the Account Terms before making a decision to deal in financial products covered by this PDS. We recommend that you contact us if you have any questions arising from this PDS or the Account Terms prior to entering into any Transactions with us. Admiral recommends that you obtain independent legal, financial and tax advice before trading.

Admiral operates on the basis that all its clients are retail clients. However, Admiral reserves the right to assess wholesale client or retail client status from time to time. If you satisfy the criteria to be classified as a wholesale client we may classify you as such. We are under no obligation to inform you if we classify you as a wholesale client but may do so as a courtesy. You must also notify us if you are funding your account with superannuation funds as that may impact your classification as wholesale or retail client.

1.4 Your Suitability to Trade Admiral Products

If Admiral asks you for your personal information to assess your suitability to trade Admiral Products and we accept your application to trade Admiral Products, this is not personal advice or any other advice to you. You must not rely on Admiral’s assessment of your suitability since it is based on the information you provide and the assessment is only for our purposes of deciding whether to open an Account for you and is separate from your decision to trade Admiral Products. You remain solely responsible for your own assessments of the features and risks and seeking your own advice on whether these Admiral Products or any particular OTC Products are suitable for you.

1.5 Changes to this PDS

A copy of this PDS, Account Terms and other respective documents can be downloaded from the website or you as the Client can call Admiral to request a paper copy of this PDS free of charge.

The information in this PDS is up to date at the time it was prepared but is subject to change at any time. Any updates will be posted on our website (www.admiralmarkets.com.au).

If the new information is materially adverse to you, we will issue either a new PDS or a supplementary PDS containing the new information. If the new information is not materially adverse to you, you will be able to view updated information on our website (at www.admiralmarkets.com.au) or by calling us using the contact details given in this document.

1.6 التواصل

Admiral can be contacted at:

Admiral Markets Pty Ltd

Level 10, 17 Castlereagh Street

Sydney NSW 2000

Toll Free:

1300 889 866

البريد الإلكتروني:

Website:

Section 2 – Features. Key Information

2.1 Key Features of Admiral Products

- Admiral Products are sophisticated, high-risk, over-the-counter financial products issued by Admiral. They are not exchange-traded.

- Each Admiral Product which is agreed and entered into with you will be entered into by Admiral as principal. Admiral makes a market in its products since it regularly states the price at which it is prepared to deal with a client as principal.

- Unlike products traded on an Exchange, OTC products are not forced to have the same standardised contract specifications as the exchange traded products. The size of the Admiral Products is expressed in Lot Sizes, depending on the particular financial product traded.

- You (the Client) must fund your Account with Admiral before an Admiral Product may be issued to you. This is done by paying at least the Initial Margin.

- The Client remains liable to pay later Margin amounts and to maintain the required amount of Margin. If you (the Client) do not maintain the required Margin or do not pay the required Margin Call by the required time, your Admiral Products can be Closed Out and you (the Client) remain liable to pay for any remaining shortfall.

- There is a high degree of leverage in Admiral Products because you (the Client) pay to Admiral only Margin, not the full face value. All payments to Admiral for Admiral Products are paid as Margin, therefore the more Margin you pay, the less leverage you have.

- Admiral may apply its Negative Account Balance Policy to Negative Balances on your account in certain circumstances.

2.2 Key Benefits of Admiral Products

- Hedging: Admiral Products can be used as important risk management tools. For example, FX Products are used to hedge foreign exchange currency exposures, protect against adverse exchange rate movements and provide certainty of foreign exchange rates and cash flow. Equity Derivatives, Commodity Derivatives, and Cryptocurrency Derivative Products can give some protection against movements in the market price of the underlying asset. Index and ETF derivatives may be used to hedge or diversify risks related to investments into exchange-listed stocks.

- Speculation: Admiral Products can be used for speculation to profit from fluctuations in the underlying market, e.g., exchange rate fluctuations for FX Products or the market price of the underlying asset for Commodity Derivatives, Equity Derivatives, Index Derivatives, Bonds Derivatives, Cryptocurrency Derivatives and ETF Derivatives.

- Profit potential in both rising and falling markets: Since the markets are constantly moving, there are almost always trading opportunities, whether the market price of the underlying asset is rising or falling. There is a potential for profit (and loss) in both rising and falling markets depending on the complexity of the strategy you have employed.

- Tailored: A major benefit of entering into an Admiral Product is that the transaction is not forced to have the same standardised contract specifications as the exchange traded contracts. For example, Admiral allows you to enter into transactions in smaller amounts for example 0.01 of a Lot, whereas exchange-traded contracts are a standard size.

- Leverage: Admiral Products involves a high degree of leverage. These OTC products enable a Client to outlay a relatively small amount (in the form of Initial Margin) to secure an exposure to the full face value of the product. This leverage can work for or against you. The use of leverage can lead to large losses as well as large gains.

- Negative Account Balance Policy: Where the net balance of your accounts with Admiral has fallen below zero, you may be eligible for relief under the Negative Account Balance Policy.

2.3 Key Risks of Admiral Products

This is an outline of the key risks of investing in Admiral issued products. For a description of all of the significant risks, please see Section 4.

- Leverage – Admiral Products are highly leveraged, because the amount you pay (Margin) to Admiral is significantly less than the full face value. You should be prepared for the greater risks from this kind of leveraged investment, including being liable to pay Admiral more Margin and those Margin requirements changing rapidly in response to changes in the relevant underlying market.

- Loss of your moneys – Your potential losses on dealing in Admiral Products may exceed the amounts you pay (as Margin) for your Admiral Products, or amounts Admiral holds in Admiral Trust Account, Wholesale Client Trust or the Security Trust Bank Account for you.

- Unlimited loss – Your potential losses on Admiral Products may be unlimited.

- Limited recourse – Admiral limits its liability to you under the terms of the Admiral Products by the extent to which Admiral actually recovers against its Hedge Counterparty and allocates that to your Admiral Products. This key risk is linked to “counterparty risk”. Both limited recourse risk and counterparty risk are further explained in Section 3.19 “Your Counterparty Risk on Admiral”.

- Trust moneys are withdrawn to pay for your Admiral Products – moneys which you pay into the Admiral Trust Account or Wholesale Client Trust may not be retained in that account and can be withdrawn to pay Admiral for your Admiral Products.

- If the moneys are withdrawn as payments to Admiral, they are not retained in the Admiral Trust Account or Wholesale Client Trust for you and you (the Client) lose the benefits of holding those moneys in the Admiral Trust Account or Wholesale Client Trust. Admiral has adopted the Security Trust, described under Section 3.19 “Security Trust”.

- Margining – You (the Client) is liable to pay Margin before the Admiral Product is issued and you may be required to pay more Margin before an Admiral Product is Closed Out. Margin requirements can change rapidly. If the Client do not meet the Margin requirements, so that your account’s equity reaches a certain percentage rate of the current margin collateral (expressed in percents and referred to as ‘Stop Out’ or ‘Stop Out Level’ in the respective section of Admiral Markets website at www.admiralmarkets.com.au), any or all your open Admiral Products can be liquidated at prevailing market prices. Once a Stop Out event has been triggered, Admiral Markets reserves the right to liquidate your open Admiral Products in an order which deems most appropriate, in its sole discretion, but usually liquidates your open Admiral Products starting from one with the largest floating loss. If the Stop Out conditions are still met after the liquidation of the first Admiral Product, then the next Admiral Product is selected for liquidation, and so forth, which may result in a consecutive liquidation of all open Admiral Products in your account.

- Foreign Exchange – You (the Client) can be exposed to rapid, significant and large changes to the value of your Trading Account if you hold Admiral Products which are denominated in foreign currency.

- Counterparty risk – you have the risk that Admiral will not meet its obligations to you (the Client). Admiral Products are not exchangetraded so you need to consider the credit and performance risk you have on Admiral and the limited recourse arrangements. For further explanation read Section 3.19 “Your Counterparty Risk on Admiral”.

2.4 Your suitability

Key suitability to considerations are:

- whether you have experience in trading the financial products which relate to the Admiral Products you choose;

- whether you understand the terms of Admiral Products and how they work;

- whether you understand the concepts of leverage, margins and volatile markets and prices;

- whether you accept a high degree of risk in trading in Admiral Products;

- whether you understand that the nature of trading in OTC financial products such as Admiral Products do not provide investors with interests or rights in the underlying financial products which relate to the Admiral Products;

- whether you understand the processes, technologies and terminology used in trading Admiral Products;

- whether you can monitor your investments in Admiral and manage them in a volatile market;

- whether you can manage the risks of trading in Admiral Products;

- whether you have financial resources to provide more Margin, especially on little or no notice; and

- whether you can bear substantial losses that might arise from trading in Admiral Products, especially the potentially unlimited losses on dealing in short Admiral Products.

Admiral’s assessment of you (the Client’s) suitability is based on the information given by you. Admiral’s policy includes assessing the information given to us by your online responses, by email, telephone or in meetings. Admiral may keep the information given to them by you (the Client) to help monitor our policy and for the requirements of a financial services licensee.

As a result of this assessment Admiral might limit some features for your Account.

Admiral’s assessment of you (the Clients) suitability to trade in Admiral Products and any limits that were set for your Account (or later change to those limits) should not be taken as personal advice to trade in Admiral Products nor does it imply that Admiral is responsible for any losses incurred by you (the Client) for trading in Admiral Products.

To the extent permitted by law, Admiral does not accept liability for a client’s choice to invest in any Admiral Products. Therefore you should carefully read all of this PDS, consider your own needs and objectives for investing in these Admiral Products and take independent advice where and when needed as you see fit.

Even if Admiral assesses you as suitable to commence trading Admiral Products, we urge you to use our Demo accounts to ensure you are familiar with the terminology of Admiral Products and how they work.

2.5 Nature of Admiral Products

When buying an Admiral Product the terms of any payment when it is Closed Out reflects the performance of an Underlying Reference Instrument that you have chosen including, among others, foreign exchange, spot precious metals, equities and energy futures.

The amount of profit or loss is determined by the difference between the price at which the Admiral Product is bought and the price at which it is Closed Out, adjusted to reflect interest payments or Swap charges (section 3.18 Swaps/Rollovers), or any other charges where applicable (As described in Section 5). Important: Note no physical delivery of either the Admiral Product or the Underlying Reference Instrument takes place.

Admiral Products are tailored by Lot sizes and do not have the same standardised contract specifications as exchange-traded contracts. The terms of Admiral Products are based on the Account Terms with Admiral, which apply to you (the Client’s) Trading Account(s) and your Admiral Products.

All Admiral Products traded on the Admiral MT Terminal are subject to Margin requirements, which means you (the Client) are required to pay to Admiral at least the minimum required Margin.

Essentially, the amount of any realised profit or loss made on the Admiral Product will be equal to the net of:

- the difference between the Transaction Price of the Admiral Products when the Transaction is opened and the Transaction Price of the Admiral Products when the Transaction is Closed Out, multiplied by the Lots traded and the standard volume size per (1.00 Lot);

- for all Admiral Products, any rollover/ swap Fee;

- any adjustments made in respect of the Equity Derivatives, Exchange-Traded Funds Derivatives and Cash Index Derivatives (e.g., for dividends or taxes);

- any Transaction Fees payable in respect of the Admiral Products and any other charges (for more information on Fees and Charges see Section 5 of this PDS).

Your Equity will also be affected by other amounts you must pay in respect of your Account such as Finance Charges on your Account and conversion costs (for more information on costs, fees and charges in respect of your Account, see Section 5 of this PDS).

2.6 Types of Trading Accounts offered by Admiral

2.6.1 Trade.MT4 Trading Account

Trade.MT4 Accounts offer five (5) digit quoting on FX Products and Straight-through Processing (‘STP’) on aggregated prices of banks, investment firms and other venues such as Electronic Communication Networks (‘ECNs’) on the foreign exchange and other derivatives that are based on commodities, equity index bonds, and cryptocurrency.

Trade.MT4 accounts also offer access to pricing on foreign equity derivatives from various trading venues, including, but not limited to, liquidity providers with specialisation on equity derivatives.

Since the foreign exchange market is predominantly unregulated, there is no central exchange for foreign exchange and trading is performed on an “Over the Counter” (OTC) market.

Specifically, the underlying cryptocurrencies market is largely unregulated to the date and encompasses some OTC features such as absence of a central exchange and any reliable source of the benchmark price.

The Account Terms and trading conditions (for example the minimum deposit and leverage for the financial products offered) relating to the Trade.MT4 Accounts are available on: www.admiralmarkets.com.au or you can download a demo account.

2.6.2 Zero.MT4 and Zero.MT5 Trading Accounts

Zero.MT4 and Zero.MT5 Accounts offer five (5) digit quoting and a wider range of available FX Products. These account types are designed for clients most interested in trading in foreign exchange currency pairs. Spreads on FX Products in Zero.MT4 and Zero.MT5 accounts start from 0 points, however, every trade is charged commission, being a percentage of the notional trade value. Zero.MT4 and Zero.MT5 accounts also feature a few metal derivative products.

The Account Terms and trading conditions (for example the minimum deposit and leverage for the financial products offered) relating to the Zero.MT4 and Zero.MT5 Accounts are available on: www.admiralmarkets.com.au or you can download a demo account.

2.6.3 Trade.MT5 Trading Account

Trade.MT5 Accounts offer the widest selection of Admiral Products. This Trading Account may be accessed only via Admiral MT Terminal MetaTrader 5 (web, desktop or mobile versions). MetaTrader 5 is the newest Admiral MT Terminal designed specifically for clients looking for a diversity of accessible markets.

The Account Terms and trading conditions (for example the minimum deposit and leverage for the financial products offered) relating to the Trade.MT5 Accounts are available on www.admiralmarkets.com.au or you can download a demo account.

2.7 Admiral Products

The Admiral Products available on the Zero.MT4 and Zero.MT5 Trading Accounts are limited to FX Product, metals and cash index derivatives. Trade.MT5 Trading Account offers the widest selection of Admiral Products. Trade.MT4 Trading Account offers access to all Admiral Product types (except for ETF Derivatives), however the number of accessible particular Equity, Commodity and Cryptocurrency derivative products is less in comparison to Trade.MT5 Trading Account.

2.7.1 Spot FX Product

A Spot FX Product is an OTC agreement to exchange an amount in one currency for an amount in another currency at an Exchange Rate agreed on the day of the trade. Trading FX Products, a combination of two currencies are traded (known as a currency pair). A FX Product is opened by buying an Admiral Product which is based on either buying or selling the Base Currency (no physical delivery ever takes place).

Example: When choosing USDJPY currency pair, you would be buying USD by selling JPY, whereas if you were selling USD/JPY you would be selling JPY and buying USD.

The minimum Lot size on Trade.MT4 and Trade.MT5 accounts is 0.01 Lot (step 0.01 Lot(s)), with 1 Lot being equivalent to 100,000 units of Base Currency.

The minimum Lot size on Zero.MT4 and Zero.MT5 accounts is 0.01 Lot (step 0.01 Lot(s)), with 1 Lot being equivalent to 100,000 units of Base Currency.

FX Products traded on the Admiral MT Terminal cannot be settled by the physical or deliverable settlement of the currencies on their Value Date; rather, these financial products can be rolled or swapped indefinitely until you decide to close out the Transaction. For further details refer to the Section 3.18 “Swap/Rollover” and for the relating fees and charges refer to the Section 5.4 “Finance Charge Adjustment/ Finance Credit Adjustment”.

2.7.2 Commodity Derivatives

Commodity Derivative Products include several products from three main underlying commodity classes: metals, energy and agriculture.

Commodity Derivative Products are OTC agreements with Admiral settled in cash by reference to buying or selling a certain quantity of a particular commodity at the price agreed on time traded against currency (typically against the US dollar). Due to the nature of OTC agreements, such Commodity Derivative Products traded on a bilateral basis with Admiral cannot be settled by the physical or deliverable underlying assets.

If Commodity Derivatives are described on Admiral’s website as futures contracts, such Commodity Derivatives have set Expiry Dates, upon or after which the position will be Closed Out automatically.

If Commodity Derivatives are described on Admiral’s website as spot contracts or cash contracts, such Commodity Derivatives do not expire and can be rolled indefinitely until you decide to close out the Transaction.

The list of available Commodity Derivatives Products and relevant detailed contract specifications (for example the minimum contract size and trading schedule) are available on: www.admiralmarkets.com.au

2.7.2.1 Spot Metal Derivatives

A Spot Metal Product is an OTC derivative agreement settled in cash by reference to buying or selling gold and silver at the Spot price agreed on the day traded against the US dollar.

A Metal Product is opened by either buying or selling by reference to the Spot metal traded against USD or another currency. For example if you were buying XAUUSD (an instrument described on our website as gold versus US dollar), you would be buying gold derivative by selling a reference amount of USD, whereas if you were selling XAGUSD (an instrument described on our website as silver versus US dollar), you would be selling silver derivative by buying a reference amount of USD.

The minimum contract size for gold spot is 0.1 Lot (step 0.1 Lot) with 1 Lot being equivalent to 100 ounces of gold.

The minimum contract size for silver spot is 1.0 Lot (step 1.0 Lot) with 1 Lot being equivalent to 5000 ounces of silver.

Spot Metal Products traded on the Admiral MT terminal cannot be settled by the physical or deliverable settlement of the spot metals on their Value Date, rather these products can be rolled or swapped indefinitely until you decide to close out the Transaction. For further details refer to Section 3.18 “Swap/Rollover” and for the relating fees and charges refer to the Section 5.4 “Finance Charge Adjustment/Finance Credit Adjustment”.

2.7.2.2 Spot Energy Derivatives

Energy Derivatives are an easy way to access indirectly commodities markets, such as oil and gas. Energy Derivatives give traders and investors indirect exposure to the underlying commodity without physical delivery, with the trading features of an Admiral Product being a simple alternative to directly trading in the exchange traded futures contract for those commodities.

All Energy Derivatives will be cash settled.

Instead of directly trading on the futures Exchanges – with sometimes prohibitive contract sizes and high collateral requirements – investors can access leveraged commodity trading with reduced initial investment through Energy Derivatives. For instance, the Energy Derivative minimum Lot size of 0.1 of a Lot of US Crude Oil is equivalent to 10 barrels of the underlying commodity, compared with the relevant Exchange’s minimum futures contract trade size of 1 contract equivalent to 1,000 barrels of the underlying commodity, which means easier and more flexible trading.

If Energy Derivatives are described on Admiral’s website as futures contracts, such Energy Derivatives have set Expiry Dates, upon or after which the position will be Closed Out automatically.

If Energy Derivatives are described on Admiral’s website as spot contracts, such Energy Derivatives do not expire and can be rolled indefinitely until you decide to close out the Transaction.

None of the Energy Derivatives will incur any overnight Financing Charge Adjustment except the cases described further in clause 5.4.

2.7.2.3 Spot Agricultural Commodity Derivatives

Agriculture Derivative Products allow Admiral Clients to indirectly access markets of agricultural products, such as cotton, coffee, and sugar. Instead of trading large contract sizes and paying high margins on the futures exchanges investors may gain leveraged exposure to agricultural commodity instruments with reduced initial margin requirements through Agriculture Derivative Products offered by Admiral.

For instance, the SUGAR.WHITE (an instrument described on our website as white sugar versus US dollar) minimum Lot size of 1 is equivalent to 10 tonnes of white sugar, compared with the relevant Exchange’s minimum futures contract trade size of 1 contract equivalent to 50 Tonnes of white sugar. This allows Admiral Clients for more flexibility and precision in the execution of their trading strategies.

All agricultural commodity derivatives will be cash settled.

2.7.3 Equity Derivatives

Equity Derivatives are OTC agreements which derive their price from the fluctuations of the price of the Underlying Reference Instrument on the relevant Exchange or market.

Prices are only quoted for Equity Derivatives and can only be traded during the open market hours of the relevant Exchange on which the Underlying Reference Instrument is traded or within any additional limited hours set by Admiral from time to time.

Admiral might not quote for an Equity Derivative for a particular Underlying Reference Instrument if that Underlying Reference Instrument is illiquid or is in suspension (for more information refer to Market Disruptions in Section 4). Furthermore, Admiral might not quote Equity Derivatives if the Equity Derivative is over shares in a company which becomes externally administered. These features may occasionally raise significant risks to you (the Client) for further details refer to Section 4.

Equity Derivatives allow you to receive economic benefits similar to those from directly owning the Underlying Reference Instrument on which the Equity Derivative is based without physically or legally owning it (for more information on benefits of trading in Admiral Products refer to Section 2 under “Key Benefits of Admiral Products” of this PDS).

Admiral currently offers Equity Derivative products derived from the securities of approximately 3000 of the largest capitalized companies that are listed on more than 10 world’s most prominent stock exchanges in the USA and the EU. Further details, regarding which Equity Derivatives Admiral provides quotes, refer to the Admiral Market website www.admiralmarkets.com.au; download a Demo trading platform or contact Admiral directly. The available Equity Derivatives may change at times due to market conditions, Exchange rules and any limits set by Admiral.

The minimum Lot size for the US Equity Derivative Product is 1.0 Lots (step 1.0 Lots) with 1 Lot being equivalent to 1 unit of the Underlying Reference Instrument.

Equity Derivatives do not have an expiry date and will remain open until Closed Out- refer to the Section 5.4 ” Finance Charge Adjustment / Finance Credit Adjustment” for the fees and charges relating to keeping the position open.

2.7.4 Cash Index Derivatives

Trading in respect of movements in indices allows you to gain indirect exposure to a large number of different shares in one single transaction. Index Derivatives can also be used to take positions on the direction of a whole market without taking a view on the prospects for any particular company’s shares.

Index Derivatives derive their price from the real time fluctuations in the value of the index which makes up the Underlying Reference Instrument for the Admiral Product, as calculated by the relevant Exchange or index sponsor, as the case may be for each particular index or, if that is not available, Admiral’s determination of the index level.

Similar to Equity Derivatives, prices are normally only quoted for Indices and can only be traded during the open market hours of the relevant Exchange or index sponsor or within any additional limited hours set from time to time by Admiral).

When trading on futures Exchange, it is important to remember that the current price of the underlying futures contracts will not normally be the same as the price of the underlying index.

Indices allow you to trade anticipated market trends rather than individual shares or other financial products. In addition, Margin requirements for Indices are typically lower than for Equity Derivatives.

The minimum contract size is 0.1 Lot (step 0.1 Lot).

Refer to the Section 5.4 ”Finance Charge Adjustment / Finance Credit Adjustment” for fees and charges relating to keeping the position open.

Index Derivatives in Admiral MT Terminal are mostly available in a form of Cash Index Derivative. Appropriate indication if the particular Index instrument is cash or futures-based derivative is posted in the Instrument description under Relevant Trading Account page on: www.admiralmarkets.com.au

Unlike index futures based instruments; Cash Index Derivatives do not expire. Both cash and futures type indices cannot be settled by the physical or deliverable settlement on their Value Date, rather these products can be rolled or swapped indefinitely until you decide to close out the Transaction.

Cash Index Derivatives are subject to the effect of corporate actions of prospects forming up related underlying index such as dividend payouts. When an individual stock which is a constituent of a cash index goes ex-dividend, this will have a weighted effect on that cash index, known as the “index dividend” or “index impact”. Admiral will make adjustments to those accounts with a position in an affected index, if that position is open the end of daily trading session on the day prior to the ex-dividend date. Admiral will credit long positions and debit short positions (by means of a cash adjustment) as follows:

Index dividend x position size

The weighted effect of an individual stock’s dividend is calculated as follows:

Index Dividend = Share Dividend x (Shares in index / Index Divisor)

The “Index Divisor” varies from index to index, it is a value which is adjusted by the underlying exchange to offset the effect of changes resulting from, but not limited to, stock splits, bonus issues and constituent substitutions. This allows the index value to remain comparable over time. Admiral uses various data providers in determining its calculation of the index dividend.

The DAX 40 cash index is not subject to adjustments; it is a total return index and as such all ex-dividends is automatically reflected in the price.

Futures based indices are not affected by ex-dates and dividend payouts as anticipated future dividends are already priced in to the market.

2.7.5 ETF Derivatives

ETF Derivatives are OTC agreements which derive their price from the fluctuations of the price of the Underlying Reference Instrument - an exchangetraded fund. Similar to Equity and Index Derivatives, prices are only quoted for ETF Derivatives and can only be traded during the open market hours of the relevant Exchange on which the underlying reference ETF instrument is traded.

ETF Derivatives allow you to trade anticipated market or sector trends rather than individual shares or other financial products.

Admiral might not quote for an ETF Derivative for a particular Underlying Reference Instrument if that Underlying Reference Instrument is illiquid or is in suspension. Furthermore, Admiral might not quote, or stop quoting without any prior notice to clients, any ETF Derivative product if such ETF Derivative is over shares of and exchange-traded fund which enters into liquidation or becomes subject to delisting from a relevant exchange market. These features may occasionally raise significant risks to you (the Client). For more information refer to Market Disruptions in Section 4.

The minimum contract size for ETF Derivatives is 1 Lot (step 1 Lot) with 1 Lot being equivalent to 1 unit of the Underlying Reference Instrument.

ETF Derivatives do not have an expiry date and will remain open until Closed Out- refer to the Section 5.4 ” Finance Charge Adjustment / Finance Credit Adjustment” for the fees and charges relating to keeping the position open.

2.7.6 Bonds Derivatives

Bonds Derivatives are OTC agreements which derive their price from the fluctuations of the price of the Underlying Reference Instrument on the relevant Exchange or market.

All Bonds Derivatives will be cash settled.

Prices are only quoted for Bonds Derivatives and can only be traded during the open market hours of the relevant Exchange on which the Underlying Reference Instrument is traded or within any additional limited hours set by Admiral from time to time.

The minimum Lot size on Admiral.Markets account is 1.0 Lot (step 1.0 Lot(s)), with 1 Lot being equivalent to 100 units of the Underlying Reference Instrument.

Bonds Derivatives in Admiral MT Terminal are mostly available in a form of futures-based derivative. Appropriate indication if the particular Bonds instrument is cash or futures-based derivative is posted in the Instrument description under Relevant Trading Account page on: www.admiralmarkets.com.au

If Bonds Derivatives are described on Admiral’s website as futures contracts, such Bonds Derivatives have set Expiry Dates, upon or after which the position will be Closed Out automatically, with cancellation of all active pending orders. The expiry date of the current futures-based derivative Instrument can be also found in the Instrument description on Admiral’s website.

If Bonds Derivatives are described on Admiral’s website as futures contracts, such Bonds Derivatives do not allow you to receive any additional economic benefits similar to those from directly owning the Underlying Reference Instrument on which the Bonds Derivative is based, such as coupon payments.

Unlike futures contracts traded on relevant exchanges, Bonds Derivatives offered by Admiral may not have fixed requirements for initial and maintenance margin, and can be traded on the leverage basis as described further in clause 5.7.

None of the Bonds Derivatives will incur any overnight Financing Charge Adjustment except the cases described further in clause 5.4.

2.7.7 Cryptocurrency Derivatives.

Cryptocurrency Derivatives enable an indirect access for trading the cryptocurrency assets, such as Bitcoin or Ripple. Cryptocurrency Derivatives give traders and investors indirect exposure to the underlying cryptocurrency assets without physical delivery.

Instead of trading directly via cryptocurrency exchange venues – which involves counterparty risks, since these venues are largely unregulated, as well as risks loss of funds in result of hacking – traders and investors can access leveraged trading in Cryptocurrency Derivative products issued by Admiral, with the benefit of trading with a regulated entity and without the need for a specialized software such as wallets, cold storage devices and any other infrastructure elements required for direct operations with cryptocurrencies.

All clients are advised to read the contract specifications related to the Cryptocurrency Product in the relevant section of the Admiral website at www.admiralmarkets.com.au to figure out the parameters of the offered product and its distinct differences from the respective underlying assets.

For example, the Bitcoin Derivative minimum lot size of 0.1 of a lot of Bitcoin vs US Dollar CFD is equivalent of 0.1 of the value of 1.0 units of the underlying cryptocurrency asset Bitcoin (BTC or XBT) expressed in US Dollars, which means that the minimum fraction of the Bitcoin (so-called ‘Satoshi’ or 0.00000001 BTC) is not supported by Admiral.

The maximum trade size of the Cryptocurrency Derivative may be limited at the fixed amount of lots – e.g. 3.0 lots BTCUSD; additionally, the maximum notional value of all open positions in Cryptocurrency Derivative products may be limited at a fixed level – e.g. 10’000 EUR or equivalent in another deposit currency.

The limitations currently applied to the Cryptocurrency Derivative product are intended for protection of clients from the excess volatility of the underlying assets and from additional degree of slippage which may occur in result of execution of larger orders on ‘thin’ markets.

A Cryptocurrency Derivative product is opened by either buying or selling by reference to the underlying asset price derived from the cryptocurrency exchange venue against USD or another currency. For example, when you were buying BTCUSD (Bitcoin vs US Dollar), you would be buying Bitcoin derivative by selling a reference amount of USD, whereas if you were selling BTCUSD, you would be selling Bitcoin derivative by buying a reference amount of USD.

Admiral has discretion to apply short sale restrictions to some of the Cryptocurrency Derivatives, which means that such instruments can be only used with Buy, Buy Stop and Buy Limit orders to open a new position, and Close, Take Profit and Stop Loss to close a position

Cryptocurrency Derivatives traded on the Admiral MT terminal cannot be settled by the physical or deliverable settlement, rather these products can be rolled indefinitely until you decide to close out the Transaction. For further details refer to Section 3.18 “Swap/Rollover” and for the relating fees and charges refer to the Section 5.4 “Finance Charge Adjustment/Finance Credit Adjustment”.

2.8 Benchmark Disclosure

ASIC has introduced benchmarks for over-the-counter derivatives which include OTC margin foreign exchange financial products. While it is not clear that ASIC’s benchmarks apply to any or all of the Admiral Products, Admiral has chosen to apply the benchmarks to all of the Admiral Products.

It is important to note that the benchmarks are not mandatory and are not law. ASIC has introduced them by way of stating in Regulatory Guide 227 ASIC’s expectations. Not meeting the benchmarks is not an indication of breaches or failures. Rather, the benchmarks in RG 227 also require prominent disclosure in a PDS as to whether an issuer meets the benchmarks or, if not, the reasons why they are not met are explained in the PDS. ASIC states in its RG 227 that it should also apply to margin foreign exchange financial products and comparable financial products but without describing any further how that actually applies.

The following table summarises the benchmarks as Admiral applies them to Admiral Products, whether Admiral meets them and, if not, why not. The table also refers you to other Sections of this PDS for more information on relevant topics (to avoid duplicating the information in this PDS).

|

ASIC RG 227 Benchmark |

Admiral |

|

1. Client qualification If an issuer meets this benchmark, the PDS should clearly explain:

و

|

Admiral believes that it meets this benchmark. Please see Section 2.4 “Your Suitability”. |

|

2. Opening collateral If an issuer meets this benchmark, the PDS should explain the types of assets the issuer will accept as opening collateral. If an issuer accepts non-cash assets as opening collateral (other than credit cards to a limit of $1000), the PDS should explain why the issuer does so and the additional risks that using other types of assets (e.g. securities and real property) as opening collateral may pose for the investor. This includes, for example, the risks of ‘double leverage’ if leveraged assets are accepted as opening collateral |

Admiral does not meet this benchmark because it accepts as collateral for opening the account payments by credit card for more than $1,000. Funding an Account by credit card has additional risks and costs for the Client. By using these payment methods the client would effectively be doubling their leverage by taking credit from their credit card account and trading with leverage on their Admiral Account. This can add to the risks and volatility of their positions as well as incurring higher interest costs on their credit card account. If clients lose on their Admiral Products, they might not have other financial resources to repay their credit card account, incurring higher interest costs and possibly defaulting on their credit card terms. Although Admiral accepts payments of more than $1,000 from credit card accounts to fund the clients Account and to meet later Margin payments, the client should carefully consider whether this payment method is suitable for their trading and limit it to what they can afford. Admiral Markets does not impose a limit on the amount of credit card funding a client can use because it recognises that different clients have different funding requirements that are specific to their needs. Admiral Markets do not provide personal financial product advice which takes into account the clients personal circumstances. What the client as an investor does in relation to credit card funding is entirely up to them. Admiral Markets does not take securities or real property as collateral. Admiral otherwise meets this benchmark. |

|

3. Counterparty risk - Hedging If an issuer meets this benchmark, the PDS should provide the following explanations:

If an issuer does not meet this benchmark, it should disclose this in the PDS and explain why this is so. The PDS must include information about the significant risks associated with the product: s1013D(1)(c). The PDS should also provide a clear explanation of the counterparty risk associated with OTC Admiral Products. The PDS should explain that, if the issuer defaults on its obligations, investors may become unsecured creditors in an administration or liquidation and will not have recourse to any underlying assets in the event of the issuer’s insolvency. |

Admiral would meet this benchmark because:

|

|

4. Counterparty risk - Financial resources If an issuer meets this benchmark, the PDS should explain how the issuer’s policy operates in practice. If an issuer does not meet the requirement on stress testing, it should explain why and what alternative strategies it has in place to ensure that, in the event of significant adverse market movements, the issuer would have sufficient liquid resources to meet its obligations to investors without needing to have recourse to client money to do so. An issuer should also make available to prospective investors a copy of its latest audited annual financial statement, either online or as an attachment to this PDS. |

Admiral believes it meets this benchmark:

|

|

5. Client money If an issuer meets this benchmark, the PDS should clearly:

If an issuer does not have such a policy in place, or a policy that does not incorporate all of the elements described above, it should disclose this in the PDS. If an issuer’s policy allows it to use money deposited by one client to meet the margin or settlement requirements of another client, it should very clearly and prominently explain this and the additional risks to client money entailed by this practice. An issuer’s client money policy should be explained in the PDS in a way that allows potential investors to properly evaluate and quantify the nature of the risk, if any, to client money. |

Admiral believes it meets this benchmark in all respects. Since client moneys may be withdrawn to pay Admiral, it is not legally appropriate to describe the use of money deposited by one Client to meet the margin or settlement requirements of another Client; however to the extent permitted by the Australian Client Money Rules, certain Client moneys are withdrawn to meet the hedge contract transactions of Admiral, including margin obligations, on a net basis (without reference to specific Client transactions). The features and risks of this are clearly and prominently explained in this PDS as are the additional risks to client money arising by these features. Retail and sophisticated investor client money is not used to margin, guarantee, secure, transfer, adjust or settle dealings in derivatives for Admiral or on behalf of people other than the client. In addition, Admiral has adopted a structure that it believes benefits its Clients by way of adopting the Security Trust – see Section 3.19 “Your Counterparty Risk on Admiral” and in particular under the sub heading “Security Trust”. |

|

6. Suspended or halted underlying assets If an issuer meets the benchmark, the PDS should explain the issuer’s approach to trading when underlying assets are suspended or halted. If an issuer does not meet this benchmark, it should disclose this in the PDS and explain why this is so, as well as the additional risks that trading when underlying assets are suspended may pose for investors. To provide a full explanation of this aspect of the product, an issuer should explain any discretions it retains as to how it manages positions over halted or suspended assets, and how it determines when and how it uses these discretions. This should include disclosure of any discretions the issuer retains to:

|

Admiral believes it meets this benchmark in all respects. In relation to trading when underlying assets are suspended or halted the following (as seen in Section 6.2 “Discretions”) will apply Admiral’s significant discretions are:

When exercising discretions Admiral will comply with their legal obligations as the holder of an Australian Financial Services Licence. We will have regard to our policies and to managing all risks (including financial, credit and legal risks) for ourselves and all of our Clients, our obligations to our counterparties, market conditions and our reputation. Admiral will try to act reasonably in exercising our discretions but are not obliged to act in the best interest of you (the Client) or to avoid or minimise a loss in your Account. These discretions can come into force at any time including during normal market conditions as well as when the underlying asset is suspended or halted on the physical exchange. Additional information on Admiral’s approach to opening and closing positions that relate to these discretions on suspended or halted trading on underlying assets are described in Section 3.2 and 3.3. |

|

7. Margin calls If an issuer meets this benchmark, the PDS should explain the issuer’s policy and margin call practices. If an issuer does not have such a policy in place, or one that does not incorporate all of the elements described above, it should disclose this in the PDS and explain why this is so. To provide full and accurate information about this aspect of trading in Admiral Products, the PDS should clearly state that trading in Admiral Products involves the risk of losing substantially more than the initial investment. This will ensure the issuer meets its obligation to include in the PDS information about the significant risks associated with the product: s1013D(1)(c). |

Admiral does not meet this benchmark in certain respects. Admiral describes its margin policy Section 3.14 “Payments and Client Moneys” subheading “margin Policy “and the risks associated in Section 4. Admiral does not commit to taking any reasonable steps to notify investors before making a Margin call because that is contrary to the Account Terms and, if it applied, would tend to have a worse financial effect for all Clients generally, since they could all suffer adverse price movements while waiting for an undefined reasonable notice period, that may only later be decided after lengthy and costly legal proceedings. Admiral might attempt to contact Clients, but the Account Terms clearly require the Client (i) to maintain the required minimum Margin Cover as well as (ii) to meet any Margin call. A Client must meet the Margin Cover requirements whether or not the Client is aware of the current Margin Cover. A Client must meet a Margin call even if they have not actually received the Margin call made to the address they gave Admiral. |

Section 3 – How to Trade

3.1 Your Account

You need to establish your Account by completing Admiral’s Account application form, which will be made available for you by contacting Admiral directly or by registering online via the website www.admiralmarkets.com.au.

After completing the registration process, your personal Dashboard profile will be created. Within the Dashboard you can perform many functions including opening a real or demo Trading Account(s), choosing the Account Currency and manage money operations.

In order to open a real MT Trading Account you will need to go to the “Account Management” section of your Dashboard and fill in the online form. After completion and once Admiral accepts your application, your real Trading Account will be established and you will receive your unique login and password details. Simply download the Admiral MT Terminal in the “Software” section of your Dashboard or from the Admiral website, install it on your PC, run the terminal and enter your login data in order to begin trading. Your Account covers all of the services and products which you apply for in your application form and which are accepted by Admiral.

By opening a Trading Account, you agree to the Account Terms. Your Account Terms set out the legal terms governing your Account and your dealing in Admiral Products.

3.2 Opening an Admiral Product

The particular terms of each Admiral Product are agreed between you (the Client) and Admiral before entering into the Transaction.

Before entering into an Admiral Product, Admiral will require you to have sufficient Equity (as defined in the Glossary in Section 7) to satisfy the Initial Margin requirement for the relevant Lots of Admiral Products you wish to acquire.

All of the payments which you (the Client) make to Admiral are applied as Margin (and, if fees and charges are due, the actual Margin amount credited to your Trading Account will be an amount net of those fees and charges). The fees and charges for transacting Admiral Products with Admiral are set out in Section 5.1 of this PDS.

An Admiral Product is opened with the specifications for either buying (going long) or selling (going short). You go “long” when you buy an Admiral Product in the expectation that the price of the Underlying Reference Instrument to which the Admiral Product is referable will increase, You go “short” when you buy an Admiral Product in the expectation that the price of the Underlying Reference Instrument to which the Admiral Product is referable will decrease, You do not “sell short” the actual Admiral Product – it is the specifications of the Admiral Product that have the long or short trading conditions.

(References to “selling” an Admiral Product are a short hand, common sense way of referring to buying an Admiral Product opposite to the one you have in order to close it out.)

3.3 Closing Out Admiral Products

Admiral Products, except futures based Energy Derivatives, futures based Index Derivatives and futures based Bonds Derivatives that have a set maturity date, do not expire or have a fixed term of existence, therefore must be Closed Out by you (the Client) or rolled into the next contract month prior to expiry otherwise the contract will be Closed Out by Admiral.

Admiral Products cannot be settled by physical or deliverable settlement of the Underlying Reference Instrument on the Value Date and will be continuously rolled or swapped until they are Closed Out.

If you (the Client) wish to close out an Admiral Product before it expires and for the Open Positions to be ‘netted out’, you must select the Open Order with the view to closing the existing Admiral Product position (or part of it) at the Transaction Price quoted.

If, instead, you trade an equal and opposite Admiral Product to the open Admiral Product, each position will generate a floating (unrealised) profit or loss and will not be ‘netted out’. However you (the Client) should be aware that by not netting out positions additional fees and charges will be incurred since both positions would be treated as Open Positions. At the same time, opening such opposite Admiral Products may not incur increased Margin requirements, as only a half of the initial margin is typically required by Admiral for every Admiral Product while the same Admiral Product is opened in an opposite direction in the same amount of Lots. Margin requirements incurred in such occasions are referred to as Hedged Margin and can be found in the relevant section of the website www.admiralmarkets.com.au.

Profits and/or losses are realised if positions have been Closed Out. Profits and/or losses are unrealised if only one side of the transaction has been completed i.e. it remains an Open Position.

The amount of any profit or loss you make on an Admiral Product will be based on the difference between the amount paid for the Admiral Product when it is issued (including fees and charges) and the amount credited to your Trading Account when the Admiral Product is Closed Out (including allowance for any fees and charges).

Any profit or loss net of any fees and charges will be credited/ debited to your Equity in the Account Currency selected - refer to Section 6.1 under “Account Currency”.

At the time that the Admiral Product is Closed Out, Admiral will calculate the remaining payment rights and obligations. Since you (the Client) are required to enter into an Admiral Product to close out the existing OTC Product, there may be a Transaction Fee on the Admiral Product used to close the position – see Section 5.1 “Costs, Fees and Charges”.

In volatile markets the Transaction Price quoted to you (the Client) may not be available by the time that you chose to accept the price offered and you (the Client) may require another quote.

In order to provide the Admiral Products in an efficient and low-cost manner, Admiral has discretion in determining closing Transaction Prices.

In general, without limiting Admiral’s discretion, it should be expected that Admiral will act reasonably and have regard to a range of relevant factors at the time, such as the value of the hedge contract taken by Admiral to hedge its Admiral Product issued to you (the Client), the closing price of the Admiral Product and any foreign currency exchange rates which are relevant due to the denomination of your Admiral Products or Trading Accounts. Admiral also has the right to decide to make an adjustment in any circumstance if Admiral considers an adjustment is appropriate. Admiral has a discretion to determine the extent of the adjustment so as to place the parties substantially in the same economic position they would have been in had the adjustment event not occurred.

Admiral may elect to Close Out a position without prior notice to you (the Client) if an adjustment event occurs and it determines that it is not reasonably practicable to make an adjustment.

Although there are no specific limits on Admiral’s discretions, Admiral must comply with its obligations as a financial services licensee to act efficiently, honestly and fairly.

3.4 Dealing

Quotes for Transaction Prices for dealing in Admiral Products are indicative only and so are subject to the actual price at the time of execution of your Transaction. There is no assurance that the Admiral Product will actually be dealt with at the indicative quote. You (the Client) have a risk in price movement until the trade is made.

Quotes are normally only given and transactions made on Admiral Products, excluding FX Products and Metals Products, during the open market hours of the relevant Exchange on which the Underlying Reference Instruments are trading. The trading hours of the relevant Admiral Product relating to the type of Admiral Trading Account are available on the Admiral website by selecting the relevant Admiral Trading Account & Admiral Product or by contacting Admiral.

Occasionally, Admiral may, within its discretion, impose limited trading hours.

Admiral may at any time in its discretion without prior notice impose limits on Admiral Products in respect of particular Underlying Reference Instruments. Ordinarily Admiral would only do this if the market for the particular Underlying Reference Instrument has become illiquid or its trading status has been suspended or there is some significant disruption to the markets including trading facilities or the company has become externally administered.

You (the Client) should be aware that the market prices and other market data which you view through Admiral’s online trading platforms or other facilities which you (the Client) arrange yourself may not be current or may not exactly correspond with the Transaction Prices for Admiral Products Asked or dealt by Admiral.

Accessing your Accounts and any online trading platform outside of the hours when live Orders may be accepted on the relevant market, you should be aware that the Orders may not be accepted until the relevant market is open to trading, by which time the current prices might have changed significantly.

Trades cannot be executed below set minimum trade sizes expressed as a portion of a lot for example 0.01 Lot. The minimum trade size available for each Admiral Product is displayed when the Order is placed for the Admiral Product selected on the order ticket on the Admiral MT Terminal Platform or the information is available on the Admiral website.

3.5 سبريد

When requesting a price quote for Admiral Products you will notice that there is a Bid Price and an Ask Price (collectively ‘the quotes’) being a lower and higher price at which you can place your Order. The difference between the Bid Price and Ask Price is termed the Spread and it provides an indication of where you can buy Admiral Products at, being the higher price, and where you can “sell” Admiral Products at, being the lower price (see comment above, in Section 3.2 “Opening an Admiral Product”, on what is meant by “selling”).

Admiral makes hedge contracts at or around the same time as it issues the Admiral Product to you (the Client) by placing a corresponding hedge contract with its Hedge Counterparty, being its related entity Admiral AS. The Hedge Counterparty may hedge directly into the market or it may make a market itself in its hedge contract made with Admiral.

At any time, this Bid Price (sell price) represents the best current price at which you can sell Admiral Products and the “offer” or Ask Price (buy price) represents the best current price at which you can buy Admiral Products at that time in a Transaction with Admiral, subject to price movements up to the time of actual execution.

The spread that you will be actually quoted is displayed on the order ticket when your Order is placed on your Admiral MT Terminal. An indication of the spread that you will be quoted for the Admiral Products will be available on the website at www.admiralmarkets.com.au

Generally the spread quoted for the Admiral Products on your Admiral MT Terminal are competitive, but you should be aware that Admiral is responsible for setting the spread quoted for opening and closing Admiral Products and

Admiral does not act as your agent to find you the best prices.

In order for you to break even the price that you exit your trade would need to be at a level that covers the spread and any fees and charges.

3.6 Valuation

During the term of Admiral Products, Admiral will determine the value of your Trading Account(s), based on the current value of the Admiral Products in your Trading Account(s) defined as your Equity (see the Glossary in Section 7). The current value of your Admiral Product positions are ordinarily marked to market on a continuous basis, using the current market price being the price available to Admiral from Admiral AS being its only Hedge Counterparty (some Admiral Products are not tradable during closed hours of the relevant underlying market’s Exchange, so the value of these products ordinarily will not be updated until the Exchange re-opens).

Your Equity is used to assess your Free Margin against current positions and any potential new positions you (the Client) may wish to take. (For a further explanation refer to Section 3.14 “Payments and Client Moneys” subheading “How are Margin requirements and Free Margin calculated?”).

3.7 On-line trading platform

Your Trading Account is accessible via the Admiral MT Terminal, which is a multi-product on-line trading platform upon which all Admiral Products are traded on. All Admiral Products are hedged with Admiral’s AS being the only Hedge Counterparty (Section 3.19 “Your Counterparty Risk on Admiral” subheading “Hedge Counterparty risk”).

All of your Admiral Products will use Admiral MT Terminal.

Carefully read and follow the operational rules for the Admiral MT Terminal. The Admiral MT Terminal may impose special operating rules regarding:

- paying Margin (such as when payment is posted as effective);

- how Margins are calculated or

- how Orders are managed.

Admiral strongly recommend that prior to engaging in live trading to open a “demo” account and conduct simulated trading. This enables you (the Client) to become familiar with the trading platform features and conditions.

For further assistance, Admiral provides an Online Help menu and user guide available on the Admiral MT Terminal which has a wealth of information relating to the operation of Admiral MT Terminal. If any further assistance is required, please contact Admiral on 1300 889 866.

3.8 Pricing Model

You may only trade in and out of Admiral Products by using Admirals prices. Admiral offers prices based on a modified market making pricing model where the price available to Admiral is derived from Admiral AS being it’s only Hedge Counterparty. Admiral makes hedge contracts at or around the same time as it issues the Admiral Products to you (the Client) by making a corresponding hedge contract with its Hedge Counterparty (not by placing orders directly into the market).

Admiral’s Hedge Counterparty, Admiral AS, being a related entity of Admiral, usually takes the other side of the transaction and it may choose to either not place its hedge contracts directly in the market or hedge directly into the market.

Admiral’s Bid and Ask prices to you are based on the corresponding prices offered by the Hedge Counterparty to Admiral, which generally (but is not limited to) is derived from the underlying markets. Generally the prices of Admiral Products are set on the trading platform to give competitive pricing but you (the Client) should be aware that Admiral is responsible for setting the prices of opening and closing Admiral Products but does not act as an agent to you (the Client) in finding the best prices.

3.9 Confirmations of Transactions

If you transact in Admiral Products, the confirmation of that Transaction, as required by the Corporations Act, may be obtained by accessing the daily statement online or it can be emailed on request.

Once you have entered an Order into the Admiral MT Terminal, Admiral will report the main features of your Transaction in a “pop-up” window. This is a preliminary notification for your convenience and is not designed to be a confirmation as required by the Corporations Act.

If you have provided Admiral with an e-mail or other electronic address, you consent to confirmations being sent electronically, including by way of the information posted to your Trading Account which is accessible on your Admiral MT Terminal. It is your obligation to review the confirmation immediately to ensure its accuracy and to report any discrepancies within 24 hours.

3.10 Equity and ETF Derivatives – Dividend Adjustments

If you (the Client) hold a long Equity Derivative or ETF Derivative, you will be credited with an amount equal to the gross dividend on the relevant number of the Derivative’s Underlying Reference Instruments on the Ex-dividend Date (Equity and ETF Derivatives do not confer rights to any dividend imputation credits).

Conversely, if you (the Client) hold a short Equity or ETF Derivative, your Trading Account will be debited an amount equal to the gross dividend on the Underlying Reference Instruments on the Ex-dividend Date.

Dividend adjustment payments on equity derivative Product are subject to Dividend adjustment payments are subject to local withholding taxes with the rates depending on the country where the Underlying Reference Instrument share is traded (please consult your tax advisor). Please note that dividend adjustment values displayed on Admiral’s website in this specification are based on forecasts provided by information agencies and may not correctly reflect resulting dividend adjustments that will be made on the basis of actual dividend payouts.

3.11 Equity Derivatives - Corporate Actions

If there is a corporate action by the company which issues the Equity Derivative’s Underlying Reference Instrument to which the Equity Derivative relates, Admiral may in its discretion make an adjustment to the terms of the Equity Derivative in accordance with the terms of the Trading Account. For example, an adjustment will ordinarily be made for: subdivisions; consolidations; reclassifications of shares; bonus issues; other issues of shares for no consideration; rights issues; buy backs; in specie distributions; takeovers, schemes of arrangement or similar corporate actions; a corporate action event that has a dilutive or concentrative effect on the market value of the shares. You (the Client) may not direct Admiral how to act on a corporate action or other shareholder benefit.

Admiral has a discretion to determine the extent of the adjustment and aims to place the parties substantially in the same economic position they would have been in had the adjustment event not occurred.

Admiral may elect to close a position, without prior notice to the Client if an adjustment event occurs and it determines that it is not reasonably practicable to make an adjustment. Admiral may also elect to close an Equity Derivative if the Equity Derivative’s Underlying Reference Instruments are the subject of a take-over offer, scheme of arrangement or other mechanism for change in control, prior to the closing date of the offer.

Equity Derivatives do not entitle you (the Client) to direct Admiral on how to exercise any voting rights in connection with the Equity Derivative’s Underlying Reference Instrument such as shares.

Clients should be aware that some Exchanges purge orders in securities that undergo corporate actions.

3.12 Equity Derivatives - No shareholder benefits

As a holder of an Equity Derivative; if the Equity Derivative relates to a security over listed equities, you (the Client) do not have rights to vote, receive franking credits, attend meetings or receive the issuer’s reports, nor can the Client direct Admiral to act on those rights. Other benefits such as participation in shareholder purchase plans or discounts are unavailable.

3.13 Futures Based Derivatives – Expirations

Particular Admiral’s products may have an Underlying Reference Instrument in a futures market and therefore may have a set maturity date, which essentially means a fixed term of existence. Once this term expires, the Underlying Reference Instrument is no longer traded on a relevant exchange and Admiral will Close Out any remaining open position on a futures based Derivative at the last available price on the expiry date of the Underlying Reference Instrument or no more than 2 business days later. Pending orders on any expired Instrument are also subject for cancellation by Admiral.

You have discretion to close your position on a futures based Derivative and cancel all pending orders on such Instrument manually prior to expiration. Please note that transactions in an expired instrument will be automatically blocked so you will not able to close your position after the expiry and will rely on Admiral on this matter.

Admiral has discretion to make a futures based Derivative with the next maturity date available prior to expiry of the current one or shortly after, so you are able to continue trading within the term of the next futures based Derivative.

When Admiral’s product is a futures based Instrument and is therefore subject for expirations, this is indicated on the relevant Information page on www.admiralmarkets.com.au. Such Instruments are described as Futures and have a set expiration date indicated in the Instrument specification.

Instruments with monthly expirations have ‘All Months’ value in the Contract Months parameter on the relevant Information page on www.admiralmarkets.com.au, while instruments with quarterly expirations are typically provided with ‘H, M, U, Z’ value in the Contract Months parameter, whereas H stands for March, M for June, U for September and Z for December.

Admiral has discretion, but not the obligation, to notify you of approaching expirations by internal Admiral MT Terminal mail or by e-mail.

Admiral has discretion, but not the obligation, to put Instruments with approaching expiry dates into the ‘Close Only’ mode that prohibits opening new positions not earlier than 5 business days prior to expiration.

3.14 Cryptocurrency Derivatives – Hard Forks

If there is a ‘hard fork’ action on the blockchain ledger which is supporting the reference asset of any particular Cryptocurrency Derivative, Admiral may in its discretion make an adjustment to the terms of the Cryptocurrency Derivative in accordance with the publicly available information from the entities responsible for the support of the blockchain in question. For example, a balance adjustment can be made in Client’s account in order to reflect the value of the new cryptocurrency asset derived from main asset in result of the ‘hard fork’ event.

You (the Client) may not direct Admiral how to act on a ‘hard fork’ action.

Admiral has a discretion to determine the extent of the adjustment and aims to place the parties substantially in the same economic position they would have been in had the adjustment event not occurred.

3.15 Payments and Client Moneys

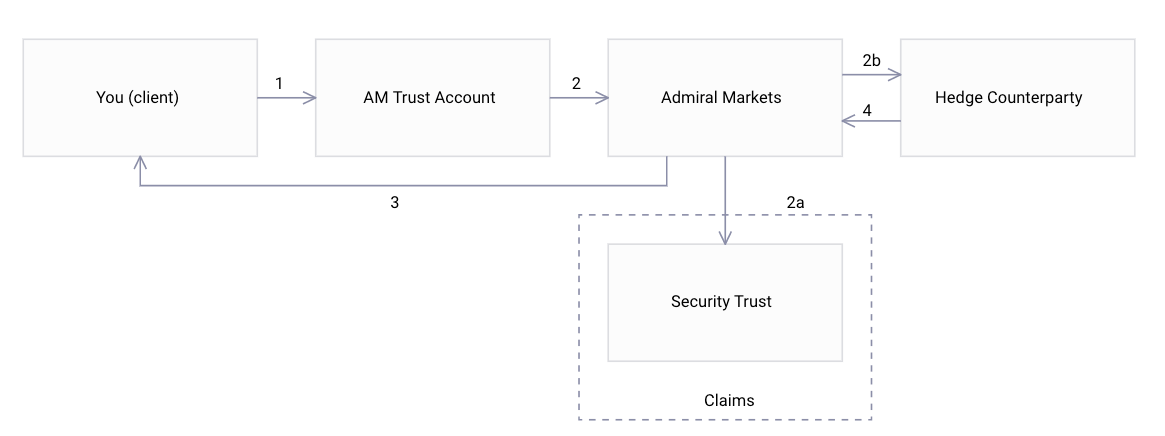

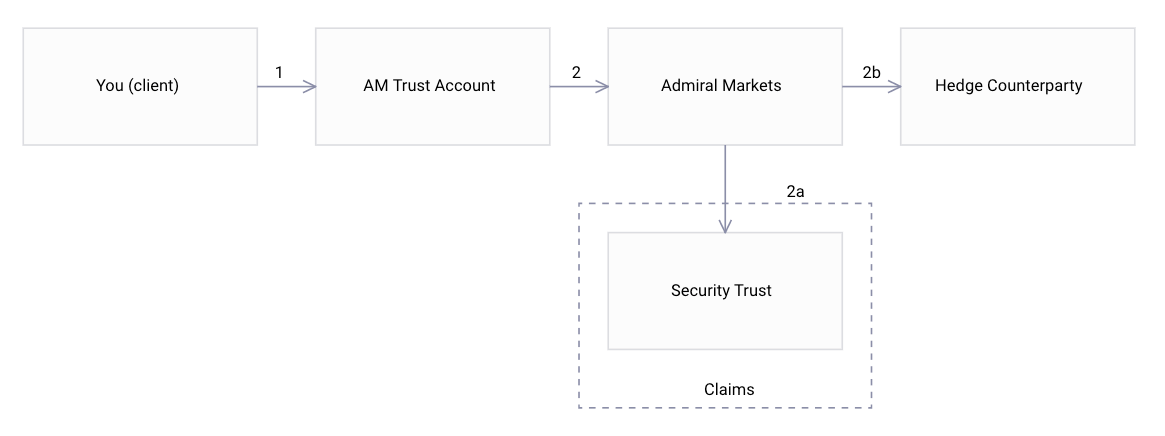

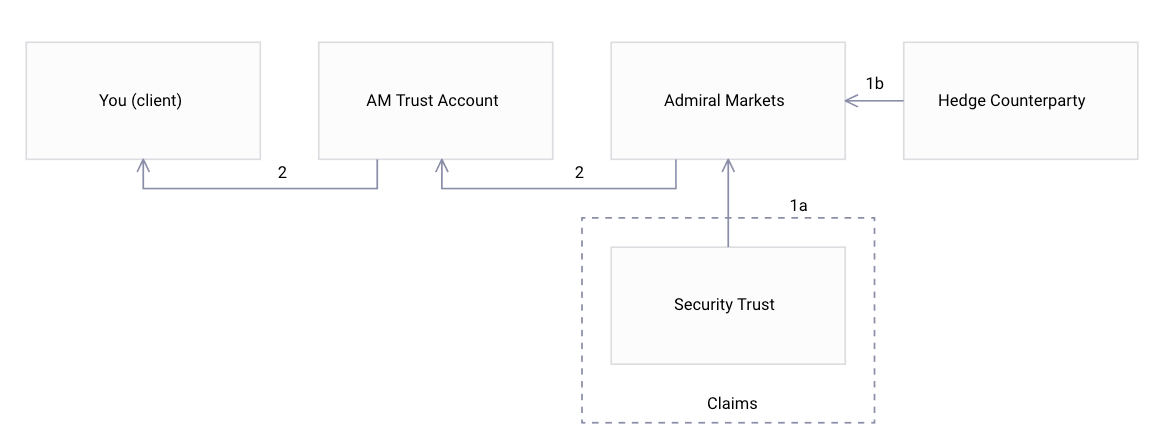

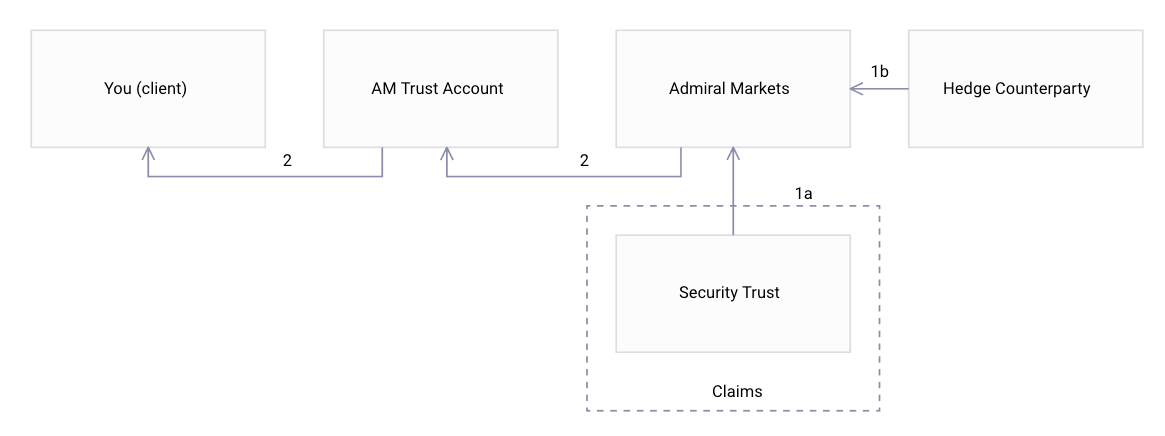

Below is a simplified diagram and summary of payments when invested in Admiral Products. A detailed explanation follows some of the scenarios further below. The simplified diagram and summary should be used as an introductory overview before reading the greater detail which follows later in this Section.

Step 1 You (as our Client) pay moneys into Admiral’s Admiral Trust Account. If you are classified by Admiral as a wholesale client, your funds will be separately paid into the Wholesale Client Trust and held separate to the client money of retail clients and sophisticated investors.

Step 2 Now that you have deposited money into Admiral’s account, it will immediately place an identical order with its Hedge Counterparty to hedge the exposure to your trades. Admiral’s position with its Hedge Counterparty is entered into using its own funds or its parent’s funds. Client money may then be withdrawn into the Security Trust. Admiral’s general policy is that, subject to its discretion and its operational requirements, it may immediately withdraw from the Admiral Trust Account or Wholesale Client Trust all of your money which you (the Client) had deposited into the Admiral Trust Account or Wholesale Client Trust, on your (the Client’s) direction and in accordance with the Account Terms, from the relevant Account. This is done to pay as Margin to Admiral for your Admiral Products (including for any other fees or charges or other payments which you owe, according to your Account Terms or for other amounts for your Trading Account). This will allow for your Trading Account to be credited in order for you to trade in the Admiral Products.

*Step 2 shows that the money is withdrawn to pay Admiral, which is the legal step. This is done by withdrawing from the Admiral Trust Account or Wholesale Client Trust. Admiral is permitted to pay that into only either a Security Trust Bank Account (Step 2A), or to the Hedge Counterparty (Step 2B).

Steps 2 and 3 are virtually simultaneous:

Step 3 Admiral Products are issued to you.

(Please see Section 3.19 of this PDS):

Before any moneys are transferred to Admiral, you (the Client) should carefully consider how your money will be held and used and the risks associated with paying your money to Admiral.

There are three important features of how your money is dealt with to establish your position:

- (i) Payment of your moneys into the Admiral Trust Account or the Wholesale Client Trust is not payment to Admiral for your positions.

- (ii) For so long as your moneys are held in the Admiral Trust Account or the Wholesale Client Trust, there are certain features and rules that apply to your money’s due to the Corporations Act.

- (iii) Your moneys are withdrawn from the Admiral Trust Account or Wholesale Client Trust to pay Admiral. From that time different features apply.

- You (the Client) have an obligation to meet the Margin call even if Admiral cannot successfully contact you.

- A Client have a risk of all of their Admiral Products being Closed Out if they do not meet the requirement to meet a Margin call.

- This obligation (to meet Margin calls) is in addition to your obligation to maintain positive Free Margin for your Trading Account.

Below are more descriptions on each of the above features. Please also see Section 3.19 of this PDS for a description of how the Security Trust works.

(i) Payment of your moneys into the Admiral Trust Account or Wholesale Client Trust is not payment to Admiral.

Moneys paid by you to Admiral for Admiral Products are initially deposited into a trust account maintained by Admiral in accordance with the Corporations Act, which is referred to in this PDS as the “Admiral Trust Account” or the “Wholesale Client Trust”.

Paying your moneys into an Admiral trust account is not payment to Admiral for your positions. Put another way, you do not satisfy your payment obligations to Admiral merely by having your moneys in the Admiral Trust Account or Wholesale Client Trust.

For so long as the Client’s money’s remain in the Admiral Trust Account or Wholesale Client Trust they are held in trust for the Client and, pursuant to the Account Terms, cannot be counted as payment for or credit for your Account (unless Admiral chooses to waive this) until Admiral acts on the direction given by the Client (each time the Client deposits funds into the Admiral Trust Account) to withdraw the funds from the trust Account. Admiral’s general policy is to make the withdrawals from the Admiral Trust Account in the ordinary course of business to allow you to trade. Admiral may also make withdrawals from the Admiral Trust Account should you be reclassified by Admiral as a wholesale client. Your funds will then be deposited into the Wholesale Client Trust and held separate to the Admiral Trust Account.

Admiral may choose to credit the Client’s Trading Account with payment to Admiral before it withdraws the funds that have been paid into the Admiral Trust Account or Wholesale Client Trust by the Client. This may be done as an advantage to Clients to facilitate dealing in Admiral Products having regard to available banking payment procedures, but if that is done by Admiral it should not be expected or be relied upon as always going to be done by Admiral. However, as explained earlier in this PDS, the general policy of Admiral is to credit your Trading Account once Admiral has withdrawn the funds which you have paid into the Admiral Trust Account or the Wholesale Client Trust.

(ii) Admiral Trust Account and the Wholesale Client Trust